Category: Treasury Management

Scope: Diversify a capped portion of the treasury to reputable groups committed to providing BTC liquidity and strategic resources, use assets to start a “Badger Backstop” Insurance Fund

Status: Accepted

Thank you to @Spadaboom for his guidance on this and @DeFiFrog and the rest of the core team for their invaluable feedback as I put this together!

Objective: To start a discussion around how Badger DAO addresses strategic partnerships and maximizes the benefit from any allocations made by these protocol participants.

TLDR: Over a three month period diversify a portion of Badger Treasury through strategic partnerships from a maximum pool of 4% of BADGER supply. Strategic allies will commit to deposit BTCs in Badger Setts. This will: Bring bear market sustainability. Start a Badger Backstop Fund. and Bring in Key Strategic Resources we need to grow.

Overview:

“Badger DAO has a singular purpose… accelerating collateralized Bitcoin across blockchains.”

Badger now sits at about $2 Billion TVL, roughly 6% of the total DeFi markets TVL. With some housekeeping out of the way (DAO Decentralization, Long Term contributor incentives, and The Grants Program), it’s time for the DAO to take further actions to ensure continued success.

Badger Treasury Assets (BADGER, DIGG) currently sit in the $600MM-700MM range. With appreciation of native assets, and a desire to maintain sustainable operations through less favorable market conditions, Badger should begin adopting a barbell investment strategy.

When managing risk your positions should fall on either end of the risk spectrum, some high risk, some no risk. We can consider non-stable assets to be high risk portfolio allocations.

Badger Backstop

With diversified funds Badger DAO can do a number of things: 1) attract higher capital inflows, 2) receive capital to help the DAO through bear market conditions, 3) use dollars in treasury for acceleration of critical goals.

The Badger Backstop fund falls under 2 and 3, providing safety for users is a critical goal. This will give the DAO capital to set up an insurance fund for users depositing in our products which will increase user trust and lead to even greater TVL being stored in the Badger ecosystem.

Two Paths

The DAO Treasury has two options:

- Diversify assets on the open market

- Diversify assets to strategic investors

In September 2018. MakerDAO received a $15MM investment from A16z, representing 6% of MKR supply. 75% off it’s all-time high, the MKR market cap was sitting just under $300MM, this helped them weather a bear market. Uniswap’s Hayden Adams recently talked about the benefits Uni has gotten from it’s investors including funding them in the depths of the bear market. Most recently Synthetix announced a $12 Million round lead by Paradigm, Coinbase Ventures, and IOSG.

Badger DAO, hub of BTC in DeFi, must continue to add value to users. Diversifying now allows us to start the Badger Backstop fund and for stable operations through market drawdowns, DeFI is still in its infancy and the actions herein will allow Badger to keep growing steadily.

While the DAO could undertake diversification selling through an AMM, the reaction may be less favorable than what we’ve researched and are presenting here, essentially as follows:

- Diversifying the treasury

- Without selling to the market

- While getting strategic value from it

This will bring lower risk through diversification and key resources needed to continue growing.

The DAO Has:

- Strong community first ethos

- Product market fit (billions in TVL, ecosystem partnerships growing daily)

- New products being delivered quickly

- A capable and forward looking team

- And… Interest from potential strategic partners

The DAO Needs:

- Steady growth through diverse revenue streams (products) & user growth (customers)

- To further diversify the treasury for long term sustainability (barbell investment strategy)

- Legacy finance/tech “skin in the game” contributors with experience and relationships (for help navigating legal, market, and otherwise)

- A path to onramp institutional money

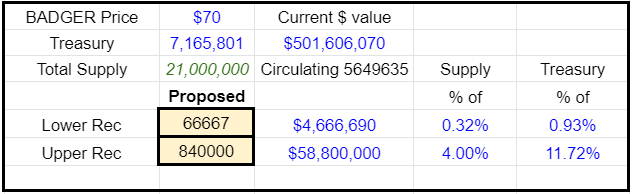

How Much: We propose allocating between 66,667(.93%) and 840,000(11.72%) BADGER from the treasury to strategic partners over the course of three months. This is .32% and 4% of total supply respectively to ensure no partner can receive a controlling interest. 840,000 BADGER is 4% of supply and 11.72% of treasury. You can play with the parameters surrounding this.

The USDC from allocations should be put into very low risk dollar lending positions on Aave segregated from, but similarly to, revenue assets.

DAO Benefits:

- BEAR MARKET SURVIVABILITY

- Starting a “Badger Backstop” Insurance fund for depositors

- Further development of products that help protect users

- User & TVL growth

- Help paving the way for institutional money to enter DeFi

- The optics of “smart money” buying in to Badger

- Asset diversification

What to think about

The market is free, if this gets voted against these investors may still make allocations in an unofficial capacity. What we offer here is a diversification based on a 7 day rolling average, in return we get valuable resources and capital. The question isn’t whether we need to diversify, it’s how we should do it.

Alternatives:

Instead of strategic partnership allocations, the DAO could sell a small % of the treasury on a recurring basis for a period. As mentioned above this may not be effective

If you want to look into this type of model you can see and play with it here.

What should be obvious from looking at this is that while we could undertake slow, steady diversification, the ease and benefits with which we can undertake a strategic partner diversification far outweigh the benefits of slow selling.

Recommendations:

- Set a cap of 4% of BADGER supply for this three month round of partner diversifications

- Allocations made in USDC

- Allocation of BADGER subject to 12 month vesting

- Tokens held at agreed address and can earn interest/multiplier benefits

- Exchange based on a 7 day rolling average from allocation inking

- Require BTC be deposited to Badger setts by each partner

Undertake individual allocations at the discretion of Badger Core, to be reported as soon as they’ve been completed due to market and volatility considerations. Core will ensure no individual allocation has a lion share of investment.

Specifics:

Upon passing snapshot Core may begin diversification with interested parties.

As allocations are agreed upon and undertaken they will be shared on Badger channels.

Vote:

- yes

- no

- yes

- no