Category Treasury Management; Annexe Investment

Scope: This BIP authorizes the core team to negotiate final investment terms (amount, valuation, etc.).

Status:* Pending

TLDR; $1-2MM investment in https://opolis.co, a web3-employment bridge, to receive $WORK token, a form of coalition ownership. Opolis will integrate bBadger and ibBTC natively as assets that any member (ACH or Crypto earner) can receive a portion of their paycheck in those assets. Opolis currently has $1.5M committed from other community contributors. BadgerDAO will work with Opolis to fill out the round of $4-5M total. Strategic investors will be targeted from the DeFi and DAO communities.

In addition, we have coordinated with the core team to host an AMA Monday morning at 9am PST, with snapshot posting no sooner than 24 hours after if quorum has been met.

Overview: Why Opolis Investment

Employment is the single common commercial thread of virtually every person on the globe. Self-sovereign paychecks are the road to user adoption of crypto and web3 ecosystems as well as creating legitimacy for those already working in the space. (For further Opolis Market Position Summary see the end of the BIP)

Market Opportunity

Virtually all HR Tech and payroll systems are designed for Corporate Consumption, not individuals. Opolis is the first to market a “Web3 friendly” employment stack offering compliance, payroll, shared services, and benefits to US-based independent workers. The Opolis Employment Commons charges a community fee of 1% of total payroll volume consumed by its Members. At scale, with potentially millions of users, the community will have one of the most stable, recurring revenue streams imaginable.

There is a secondary opportunity to integrate web3 primitives into the Opolis stack for deeper adoption of web3 technology. But a few examples of the possibilities that could be implemented:

- Portable employment records

- Portable employment verification (serving as portable KYC)

- Streaming payroll

- Tokenization & lending against independent contractor invoices

- Crypto native investment opportunities

- Direct to DeFi access

- Low cost exchange fees

- Smart contract enabled legal agreements

As a Digital Employment Cooperative, Opolis is the bridge between the real world and DeFi. Those working in the Ethereal world (DAO’s, etc) are able to access legitimate W2 employment, payroll, benefits, and shared services without sacrificing independence. An estimated 90M US workers alone will be “independent” by 2028; Opolis aims to be the global public utility for employment, compliance, and payroll. Currently, Opolis serves those qualified to work in the US, however, anyone globally can become a Coalition Member in support of the self-sovereign worker. International expansion of employment services is planned to begin in late 2021. Opolis represents the path to the next one million DeFi Workers.

$WORK is launching on April 15th. This is the one and only opportunity to get into the community before price discovery of the token.

BadgerDAO has a unique opportunity to join with Opolis in giving Opolis Employee Members exposure to Badger assets in a compliant manner as well as a long-term partnership in treasury diversification for both communities.

As Opolis is not 100% crypto native, an investment represents a real world hedge against a bear market.

Badger Adoption

Many of the early adopters of Opolis are DAO members from across the Ethereum ecosystem. A number of Badgers and many contributors of major DeFi protocols and DAOs have joined or are in the process of joining. Joshua Lapidus, a Badger Community Member, serves as Membership Steward of Opolis.

Community Involvement

- Opolis is founded by the founder of [ETHDenver], John Paller

- Opolis is supported by many key projects from the Etherspace. Additionally, Opolis appeals to traditional organizations looking to participate in the future of work & finance.

- The Coalition is growing quickly due to the incentives that $WORK offers Members and in anticipation of the Genesis Allocation on April 15, 2021. Pickle, Metacartel, + more.

Proposal: Integration Objectives

- Post integration, “Normie” and “Web3” Opolis Employee Members will have the ability to fund their payroll via ACH and/or crypto (USDC/DAI/USDT/ETH/BTC/BADGER) and elect to have portions of their payroll distributed in bBadger and ibBTC as part of their post-tax paycheck allocations. (Timelines to be scoped post investment close.)

- Members will have the ability to fund payroll using crypto (USDC/DAI/USDT/ETH/BTC/BADGER) having the conversions done USD compliantly and deposited into a US bank account. (Timelines to be scoped post investment close.)

Deal Details

- BadgerDAO leads strategic investment in Opolis

- $1-2M in in funds allocated from BadgerDAO

- 25% in USDC (immediate) 25% in WBTC (immediate)

- 50% in badger, bBADGER, bDIGG on a 4 year vesting schedule held in the Opolis Trustee Treasury.

- Opolis will stake/lock this portion of the investment to earn interest.

- Use 7 day twap of all non-USDC assets for determining deal amounts

- BadgerDAO receives:

- 3-6,000,000 $WORK; 20% vested, 80% vesting over 4 years via SuperFluid

- convertible grant rights (1x liquidation preference and treasury $WORK upon dissolution of the Opolis Trustee Treasury)

- Locked pro rata Treasury $WORK at Coalition Launch is 9M $WORK

- BadgerDAO Community Members receive an allocation of $WORK if they join within 6 months of $WORK Launch.

- BadgerDAO will work with Opolis to fill out a round of $3-4M.

- Opolis currently has an additional $1M of committed funds

- Strategic partners will be targeted in the DeFi and DAO communities

- I.e. other top DAO communities, DeFi projects

- Allocations to the round must be made prior to April 9th

- BadgerDAO becomes a Coalition Member (for $20) of the Employment Commons and will receive additional $WORK rewards via Payroll Mining (referred Employee Members consumption).

- BadgerDAO will include access to “services” i.e. tapping into audit allotment or development support based on mutually agreeable terms.

Use of Funds

With an estimated $4.5M in total funds raised, Opolis will have ~2 years of runway (+ locked treasury assets) to execute on the plan to reach breakeven. The following is an approximate breakdown of how the funds will be spent:

- Membership & Marketing (including wages): 40%

- Technology Development & Integrations: 45%

- General Opex & Operations Staff: 15%

The goal is to achieve break even during this period which represents, without Marketing spend, approximately 1800 Employee Members. Achieving break even and scaling to this Member size should reinforce the value of the ecosystem with respect to $WORK in addition.

$WORK Token Value & Properties (TL;DR)

$WORK is designed as a unit of account for Patronage of the Employment Commons.

Members holding $WORK are entitled to a pro rata share of profits when declared by the Commons Board of Stewards and/or Members.

For compliance reasons, only Members (Employee or Coalition) of the Employment Commons, LCA (Limited Cooperative Association) can receive profits or voting privileges.

Patronage is defined as one of the following activities:

- Payroll Consumption (payroll + taxes + benefits)

- Payroll Consumption made by referred Members. Referring Members receive $WORK for the consumption of their referrals.

- Staking $WORK in the Employment Commons.

At launch, there is no stated market value to $WORK as Opolis and the Employment Commons are not selling tokens.

As Lead Investor and Coalition Member, BadgerDAO would have a significant amount of the initial circulating supply of $WORK.

Badger earns more $WORK for referring new Employee Members.

Although the Employment Commons is not promising value of the token nor selling tokens, $WORK is a standard ERC 20 token.

Legal & Compliance

The legal design of Opolis is a first of its kind. Using a Colorado-based Limited Cooperative Association (LCA) framework, there is a securities exemption for “joint purpose organizations” which allows us to issue $WORK as a “Patronage” unit of account without having to register it with the SEC. Colorado is often referred to as the “Delaware of Co-Ops” due to its flexible structure. Colorado State statutes are accepted widely as the standard for cooperative practices.

Because we are not selling tokens we do not believe that $WORK meets any of the Howey Test criteria which would be used in evaluating any claim that it is a security and not a Utility Token. In addition, they are being allocated to Members based on Patronage of the ecosystem.

For further comfort, Colorado passed the Digital Token Act of 2019 and has also legally recognized “utility tokens” as non-securities instruments.

Next Step

- The Opolis team will host an AMA with the community ASAP

- Snapshot Vote. DEADLINE for investment is $WORK genesis, 4/15/21

If approved, funds for the Opolis deal deal will come from the funds approved in BIP for Strategic Partnerships which earmarked 840,000 Badger that can be diversified over the course of 3 months.

- Yes

- No

Deeper Resources

OPOLIS SUMMARY (Market, Growth, Value)

Addressable Market

The Web3 & DAO spaces are only a small part of the movement back toward independent work.

By 2028 it is estimated that 90M workers in the US alone will identify as “self-employed”.

There are virtually no HR/Employment frameworks or systems designed for the independent worker; none that are Web3 friendly. At scale, Opolis is the Global Public Utility for Employment serving Independent Workers and the Bridge between Web2 and Web3.

Opolis has built a Digital Employment Cooperative offering payroll, benefits, and shared services to the independent, self-sovereign worker in order to fill this void.

Opolis also plans on expanding its geographic footprint once the US Markets gain solid footing.

Badgers, and other ethereal workers, need this infrastructure to legitimize their compensation and access high quality benefits without Badger having to do it.

Concurrently, “normie”and “ethereal” workers will get access to cryptocurrencies (including Badger assets) and other DeFi tool sets as a means of driving new user adoption to Web3 and DeFi.

Examples of DeFi and Crypto tools that can be built into Opolis are:

- Access to DEXs

- Tokenized Invoices of Independent Contractors which can be borrowed against (i.e. AAVE, Lendroid).

- Crypto friendly retirement plans

- Various insurance products

- Community mortgage lending

- Portable, zero-knowledge KYC (via Bright ID and Opolis verification NFT)

Business Model

- There is a 1% community fee charged for consumption (payroll + taxes + benefits).

- The Community Fee accrues value to the Commons and $WORK holders.

- Margins are 95%+ as there is very little COGS to services provided.

- ACPV for April 2021 is estimated to be ~$5M. Community Fees ~1% of this or $50,000.

- Community Fees can be changed by the Board of Stewards and/or Voting Members after 1 year.

Growth

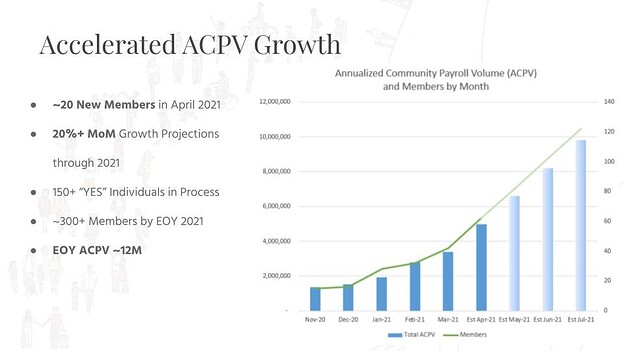

- Average of 20%+ MoM growth since November 2020.

- Growth could explode well beyond projections as $WORK is designed specifically to incentivize referrals of new Employee Members.

- Early signs of this explosive growth are becoming evident in anticipation of the $WORK launch.

- $WORK Genesis Distribution is minted and distributed April 15th.