Category: Emissions

Scope: Basic parameters for Badger + DIGG distribution.

Status: Accepted.

TL;DR:

- Gradual weekly emission reduction

- Liquidity Mining Program extends to 22 weeks after the DIGG launch

- Most of the rewards are issued in DIGG

- More rewards are distributed if Badger and DIGG grow together.

Overview.

So far, the Badger DAO has issued more than 20% of Badger’s total supply during the first seven weeks of the liquidity mining program. This rate can’t last for long.

Extending the program with gradual emission reduction will allow us to arrive at a sustainable emission rate while avoiding a steep drop in the total value locked. We will also end up distributing more rewards to long term supporters who stay with Badger when the APYs get lower.

BIP 26 outlines the plan that will allow us to extend the liquidity mining program to 22 weeks after the DIGG launch.

We have around 2.9% of Badger supply and 40% of DIGG supply available from the liquidity mining allocations. To continue distributing Badger, we need to issue less Badger and more DIGG each week than what was suggested in BIP 21.

I suggest the following adjustments to the BIP 21 parameters:

- Changing the Badger/DIGG ratios:

- for Badger Setts from 59/41 to 33/67;

- for DIGG Setts from 17/83 to 0/100.

- Keeping equal rewards for Badger and DIGG Setts for the PEG allocation as in BIP 22, plus:

- Badger Setts will keep all the excess DIGG without being affected by the PEG distribution changes.

- Max DIGG threshold parameter in the DIGG PEG model will change from 80% to 70%. This will allow for the same value distribution for Badger Setts when DIGG is at 80% of BTC price as in BIP 22.

-

Starting Badger issuance at 184,453 Badger and DIGG issuance at 4.28% supply in the first week.

-

Decreasing emissions at a rate that ranges from 10% to 7.5%. So towards the end of the program, the weekly reduction in emissions will be lower than at the beginning.

The total amount of Badger required for the extension plan is 1,746,971. We have around 600k Badger left in the liquidity program allocation, and I suggest covering the rest from the Unclaimed Airdrop fund. These adjustments will allow the program to run for 22 weeks.

The % of DIGG supply distributed during the program will depend on the DIGG/Badger price and supply ratio:

-

If DIGG outgrows Badger past a certain threshold, we save on DIGG emissions next week by using the Dynamic Emissions Model from BIP 21.

-

If Badger outgrows DIGG or both grow at the same rate, we distribute the maximum amount of DIGG that’s been allocated for the following week.

This way, the amount of dollar value that is being distributed through DIGG gets capped at the value which is supported by the Badger price.

Specifics.

If you’d like to get fully acquainted with the distribution mechanics, here’s the sheet to copy. You can choose the week you’re interested in and fill it with various numbers for Badger Price, DIGG price, and DIGG supply.

I. Weekly Emission Reduction Schedule.

BIP 21 introduced the dual token emission model where our main benchmark for value distribution is set at 2.9% of Badger supply, similar to what the DAO has been distributing so far on the weekly basis.

Here we use the same benchmark, but the rate of Badger emissions is fixed and the DIGG emission rate is dynamic but capped according to the following schedule:

100% of Badger emissions stand for 603,752 Badger. 100% of DIGG Cap means 5% of DIGG Supply. 138.18% of Total emissions stand for the value of 834,253 Badger.

II. Adjustments to the Dynamic Emissions Model.

With having considerably fewer Badger emissions available, the original dynamic emission model from BIP 21 requires a change. The adjustment I propose is using Fixed Emissions for Badger and Dynamic Capped Emissions for DIGG.

Fixed Badger Emissions imply that we have a set budget for Badger emissions for the whole duration of the program that is distributed according to the schedule above.

Dynamic Capped DIGG Emissions mean that below a certain ratio of DIGG/Badger market cap we use Fixed Emissions for DIGG distribution. Above that ratio, we use the Dynamic Emissions Model.

To track that ratio in an easier manner we can look at the price of what can be called Genesis DIGG, a.k.a. GDIGG. GDIGG price refers to the value of 1 DIGG from the 4000 that were issued on day 1 of DIGG’s existence. So if DIGG supply grows 2x, GDIGG price will be 2x higher than the DIGG price.

The proposed model is optimized for the GDIGG/Badger ratio of 3800.

In practice, it means the following.

Let’s imagine that we start at $10 Badger and $38,000 DIGG with 4,000 DIGG supply.

If Badger rises from there or Badger and DIGG rise together at the same rate, 100% of the proposed Cap of DIGG emissions gets distributed in the following week.

However, if DIGG grows and Badger doesn’t, the next week’s emissions are capped by the dollar value that’s supported by the Badger price.

For example, let’s assume that during the first week DIGG supply extended from 4000 to 5000 while DIGG and Badger prices ended up staying the same at $38,000 and $10. This would leave us with 154 DIGG to distribute for the second week. However, if Badger’s price rose at the same rate – to $12.5, that would unlock 192 DIGG for the second week of distributions.

DIGG supply that gets saved when the ratio is above 3800 stays in the liquidity mining program fund for future distribution.

III. Adjustments to the PEG Based Rewards.

The initial PEG model was built around equal DIGG emissions for Badger Setts and DIGG Setts, and Badger emissions for Badger Setts would partly cover the downside when DIGG gets below peg.

As we’re changing the ratio of Badger / DIGG emissions from 59/41 to 33/67, it creates excess DIGG emissions for Badger Setts. I suggest keeping those separated from the PEG-based allocation.

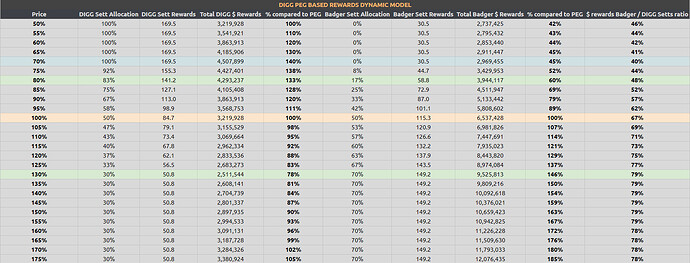

Another change is to adjust the max DIGG threshold from 80% to 70%. It means that previously 100% of PEG Based allocation would go towards DIGG Setts when DIGG is at 80% of BTC price, and now it goes at 70%.

These changes will allow keeping a similar level of rewards for Badger Setts when DIGG is at 80% of BTC price as in the original model.

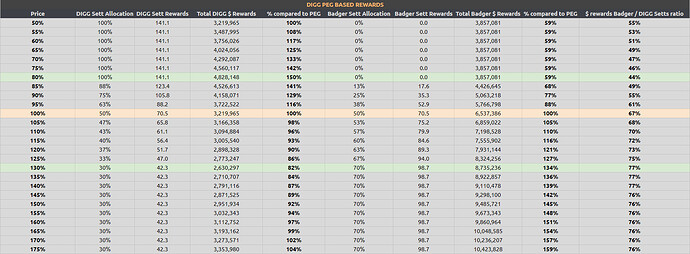

Here’s how a simulation for the original model looks:

And here’s the new model simulation:

Implementation.

To determine the DIGG allocation for the following week I suggest starting with using average Badger and GDIGG prices from the previous week. This process can be further optimized in the future by being automated with shorter time frames.

- Yes

- No

P.S. I’d like to thank @Spadaboom, @jonto, @mason, and @DeFiFrog for their help with reviewing and improving all three parts of the Badger/DIGG Emission plan.