Category: Emissions

Scope: Basic parameters for the dual token liquidity mining program.

Status: Approved

Overview.

With the DIGG launch, we transition from single to dual token emission model.

This BIP covers Part I of the Badger/DIGG Emission plan: the initial distribution ratios when DIGG is at peg.

Part II will introduce the new staking multiplier and DIGG peg based distribution model.

Part III will cover the extension plan for the liquidity mining program.

Specifics.

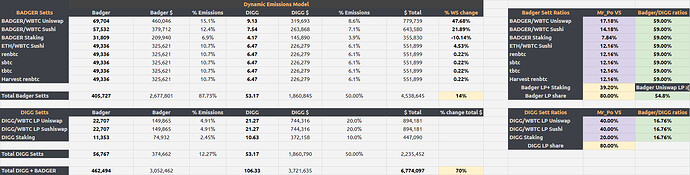

For determining weekly dual token emissions I’d like to introduce the Dynamic Emissions Model (DEMo). This model allows for the normalization of distributed value over time when using two tokens and a specific set of input parameters.

The easiest way to understand how it works is to make a copy of the Google Sheet and see how adjusting different parameters changes the weekly distributions.

The adjustable parameters are highlighted with color.

Here is the latest iteration of DEMo distributions and how they compare to Week 5 Badger emissions:

According to this benchmark model, the overall value distributed by BadgerDAO for the first week of dual emissions is planned to be 1.7x compared to the standard Badger weekly emissions.

The overall boost to the current Setts is 1.14x, Curve Setts keep the same level of rewards, and distribution is focused on building more liquidity for Badger-WBTC pairs.

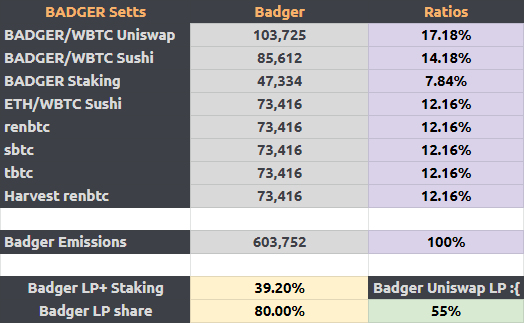

Here’s how this model translates to Pre-DIGG Badger only distributions:

Some ratios in DEMo are strategic in nature and are meant to be decided by the BadgerDAO governance.

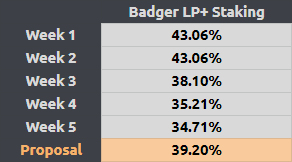

1) Badger LP + Staking Share compared to other Setts.

The first parameter to define is the % of emissions that goes to Badger liquidity providers and Badger Stakers compared to other Setts.

Here’s how this ratio looks historically:

The reasons to increase the ratio compared to week 5:

- Badger Stakers and LPs tend to keep and compound the rewards they receive.

- A higher rate of rewards would bring Badger LP and Staking Setts more on par with DIGG Setts.

- 35%

- 37%

- 39% (Proposal)

- 41%

- 43%

- Neutral

- Not Sure

2) Badger LP Share compared to Staking

Currently, with all other things being equal, if the Badger LP pool had 1000 Badgers in it, and the Staking pool had 1000 Badgers, the staking Badger would earn more rewards.

I consider this situation underincentivizing for Badger LPs.

I believe a good framework for rewarding Badger and DIGG LP and Staking Setts is to issue the same amount of rewards per Badger or DIGG pooled.

So I propose a change where when all other things are equal, 1 Badger in an LP position earns the same as 1 Badger staked. This means that 1$ of value in LP earns twice as much as 1$ in Badger staking when pool size is equal.

The larger the liquidity a token has, the more stable its price becomes. So this change is especially important for DIGG Setts.

- Yes

- No

- Neutral

- Not Sure

- Yes

- No

- Neutral

- Not Sure

3) Uniswap LP share compared to Sushiswap LP.

Using the similar logic of targeting equal rewards per Badger pooled, I suggest reconsidering the emission policy when it comes to liquidity provision at Uniswap and Sushiswap.

The current emission schedule targets equal liquidity at the two DEXes.

The problem is this way we don’t get a clear signal from Badger LPs on where they would prefer to provide their liquidity.

If we target similar rewards per Badger pooled for LPs and not the similar liquidity, we allow Badger LPs to make their own choice.

This means that at equal liquidity we offer equal rewards.

Let’s imagine that Sushiswap governance decided to win the Badger/WBTC market from Uniswap and issued Sushi rewards that would support higher liquidity and volume for Badger on their DEX.

If in this scenario Badger LPs migrated and Sushiswap liquidity outgrew Uniswap’s, Sushi LPs would not lose out on Badger rewards.

At the moment of writing, there are 462k Badger tokens pooled on Sushiswap and 866k on Uniswap. This leaves us at a 65/35 reward ratio for Uniswap / Sushiswap to balance out the rewards per Badger pooled.

However, there is a complication due to staking multiplier: people who have been Uniswap LPs for a long time receive higher rewards. So the current situation is not fully representative of LPs intentions.

My suggestion is to use pro-rata rewards once we completely switch to V2 staking multiplier, and before that to give some bonus to Sushiswap LPs.

Here’s a snapshot of how Sushiswap Bonus looks at different Uniswap LP share ratios:

In the benchmark model, I’ve used around a 55/45 ratio which grants Sushi LPs ~1.5x bonus. However, I would prefer this parameter to be set by BadgerDAO governance.

- 50/50 Uni/Sushi: same emissions for each Sett, target equal liquidity, ~1.85x bonus for Sushi

- 55/45 Uni/Sushi: pro-rata distribution with ~1.5x bonus for Sushi

- 60/40 Uni/Sushi: pro-rata distribution with ~1.25x bonus for Sushi

- 65/35 Uni/Sushi: pro-rata distribution per Badger pooled

As for DIGG Sett emissions, I suggest to start with equal emissions for both LP pools, and then to adjust the rewards pro-rata based on liquidity.

Implementation.

After Badger Community votes on specific parameters of the model, the results will be integrated into the final version of the BIP that will go to snapshot vote for week 1 of dual emissions.

As for pre-DIGG launch distributions, I suggest either using the week 5 emissions model or the ratios suggested in BIP 21.

- Yes

- No

- Neutral

- Not Sure

- Yes

- No (use Week 5 ratios)

- Neutral

- Not Sure