Category: Emissions

Scope: Basic parameters for DIGG distribution.

Status: Accepted

DIGG launch introduces three new Setts: two DIGG LPs and one DIGG staking Sett.

Those can be classified as DIGG Setts. All current Setts can be called Badger Setts.

This BIP proposes distributing different % of DIGG rewards to these two types of Setts based on where DIGG price is compared to BTC price.

- BIP 21 covers the distribution model when DIGG price = BTC price.

- When DIGG price is below BTC, DIGG Setts get more DIGG, and Badger Setts get less.

- When DIGG price is above BTC, DIGG Setts get less DIGG, and Badger Setts get more.

Badger rewards stay the same for all Setts, no matter how DIGG price moves.

Overview.

With the introduction of the dual token emissions model, part of the rewards to all Setts will be distributed in DIGG.

DIGG is a currency that targets the price of BTC.

BIP 22 leverages the financial interest of the money locked in Setts to help keep DIGG price closer to BTC price.

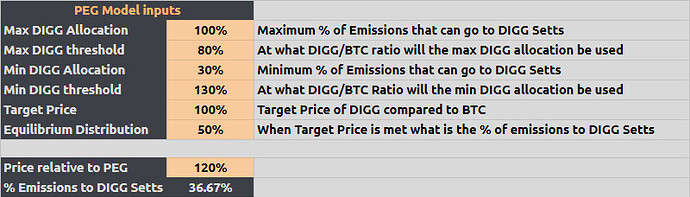

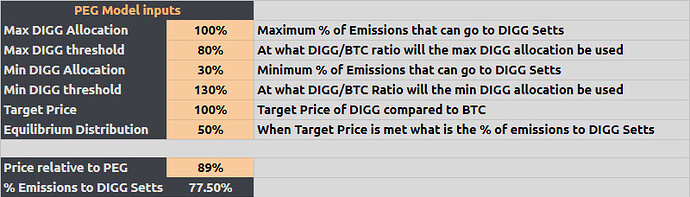

The sheet below illustrates how distributions change based on DIGG price:

With the proposed parameters and BIP 21 ratios in mind:

- When DIGG price is at the peg, 50% of DIGG emissions go to DIGG Setts, and 50% go to Badger Setts.

- If DIGG is at 80% of BTC price or below it, all DIGG emissions go to the DIGG Setts.

- If DIGG price is at 130% of BTC price or above it, 70% of DIGG emissions go to Badger Setts and 30% to DIGG Setts.

All the Badger emissions are stable: Badger and DIGG Setts receive the same amount of Badger rewards no matter what DIGG price is.

This structure:

-

Incentivizes DIGG holders to LP and Stake when the price is below peg. The higher APYs for DIGG Setts also create the necessary demand for DIGG to move its price closer to peg.

-

Motivates Badger Setts users to support the price of DIGG, as it allows them to receive larger rewards.

-

Incentivizes DIGG LPs and stakers to move the price lower when it’s above peg to receive a larger % of DIGG emissions.

Specifics:

There will be a number set at the beginning of each emission cycle for how much DIGG overall will be included in that cycle.

All Setts are classified as DIGG or non-DIGG.

At each emission cycle, the DIGG price relative to the target is checked, and the % of DIGG emissions going to DIGG Setts vs. non-DIGG Setts is adjusted for that cycle. The emissions will then be distributed to each of the Setts directly based on predetermined breakdowns for what % of DIGG emissions they get for their respective category.

There will be 6 parameters that will drive how the emissions are split:

Equilibrium is set at 50%, target price at 100%. This means that when DIGG price = BTC price, 50% of DIGG emissions go to DIGG Setts.

The minimum that will ever go to DIGG setts with the proposed parameters is 30% of emissions, which happens when DIGG is at 130%+ of BTC price.

The change between equilibrium (50% emission at 100% price) and minimum (30% emission at 130%+ price) happens linearly.

So DIGG price at 120% results in 36.67% of emissions going to DIGG Setts for the cycle.

In the second example, we see that at 89% of BTC price, DIGG Setts receive 77.5% of the total DIGG emissions for the cycle.

You can try out different parameters and see how they affect the emission breakdown in chart form here.

This is how the chart looks with the proposed parameters.

The Y-axis is the % of emissions going to DIGG Setts, while the X-axis represents the relation of DIGG price to the Target Price.

Big thanks go to @jonto for creating the specifics of the Peg Based model, setting the initial parameters, and writing a part of this BIP.

- Yes

- No

- Yes

- No