Category: Emissions.

Scope: Fix 100% of DIGG emissions to DIGG Setts, non-native Sett rewards restructure, Launch Boost.

Status: Community review.

TL;DR:

- Fix 100% of DIGG emissions to DIGG Setts for the rest of the 22 Week Liquidity Mining Program

- Double the rewards for WBTC Sett by reallocating them from harvest renBTC (100%), sBTC (50%), and tBTC (50%) Setts.

- Launch Boost for new product launches from the treasury funds outside the emission schedule (2.5x rewards first week, 2x second, 1.5x third).

Overview.

DIGG Options Rebase Mining is aimed at allowing the upcoming DIGG Stability Sett to accumulate enough BTC to support DIGG peg moving forward. To facilitate that, I suggest keeping 100% of DIGG emissions to DIGG Setts.

Another issue this BIP addresses is integrating the WBTC Sett (powered by Yearn) into the general emission schedule. The suggestion is for it to have double rewards by reallocating them from Harvest renBTC (100%), sBTC (50%), and tBTC (50%) Setts.

Lastly, I suggest making Launch Boost from the funds outside the emission schedule a standard practice. The proposed Boost is 2.5x for the first week, 2x for the second, and 1.5x for the third.

Specifics.

DIGG Emissions for DIGG Setts.

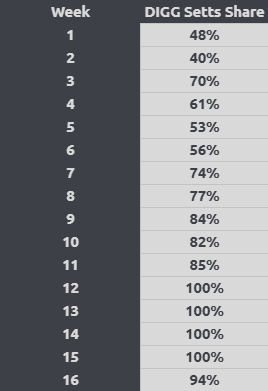

The basic principle behind the Dual Emission model (BIP 21) is the normalization of dollar value distribution between DIGG and non-DIGG Setts over time. Here’s how it played out when it comes to DIGG distribution towards DIGG Setts:

Due to the relative market cap depreciation of DIGG compared to Badger, DIGG emissions shifted towards DIGG Setts.

With the upcoming Options Rebase Mining and the launch of the Stability Sett, the DAO incentivizes DIGG market cap appreciation to build up BTC reserves that would serve for peg stabilization in the future.

In order to facilitate that, I suggest fixing DIGG emissions allocation at 100% towards DIGG Setts.

This means that DIGG market cap performance won’t affect DIGG supply distribution between DIGG and non-DIGG Setts. The change also effectively cancels out the implementation of peg-based rewards (BIP 22).

The idea is to channel DIGG emissions to facilitate building its longer-term sustainability.

- Yes

- No

With this change, the emission schedule would also become more straightforward: all Badger would be distributed to non-DIGG Setts, and all DIGG to DIGG Setts.

*GDIGG stands for “Genesis DIGG”, and can be used as a unit of account for DIGG. GDIGG supply is always 4000, so if DIGG is at 2000 supply, 1 DIGG = 2 GDIGG.

WBTC Sett Emissions.

So far all non-native Setts have been incentivized equally. And compared to renBTC and ETH/BTC Setts the other non-native Setts have been able to attract significantly less liquidity:

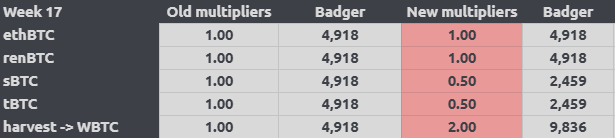

The new WBTC Sett is expected to have higher cost efficiency both in terms of TVL and the DAO treasury inflows due to higher underlying APY, so I suggest shifting 100% of harvest renBTC, 50% of sBTC, and 50% of tBTC Sett incentives towards it.

Here’s how the change would look on an example of week 17 emissions:

- Yes

- No

Launch Boost.

To bootstrap new Sett launches I suggest allocating additional rewards from the treasury that would come as a bonus to the emission schedule.

The suggested rate is:

- 2.5x first week

- 2x second week

- 1.5x third week.

Here’s how incentives for WBTC Sett would look if Launch Boost were implemented on Week 17:

- Yes

- No

When it comes to rewards for WBTC Sett specifically, for the first two weeks after launch it has been receiving 23,340 Badger per week, approved by the Badger Council.

Given that it takes longer than expected for the strategy to deploy its funds, I suggest keeping that level of rewards for another week and apply Launch Boost at a 2.5x rate to WBTC Sett at Week 17.

- Yes

- No

Implementation.

If approved by the governance, the changes can be implemented with the following emission cycle on Thursday.