DIGG is as volatile of a ‘currency’ as Badger. 1 DIGG is targeted to be worth 1 BTC, but it doesn’t mean that you will keep owning 1 DIGG.

DIGG value proposition is at targeting BTC price, that is correct. But what if it fails to do so?

Having DIGG value backed by Badger value is a good thing for DIGG.

At least for the early stage, when its value is not set in stone and we have not rolled out more advanced price stabilizing methods.

Having a rebasing token that exists on its own overall is an inferior model to the model where rebasing token is backed by another value-producing asset.

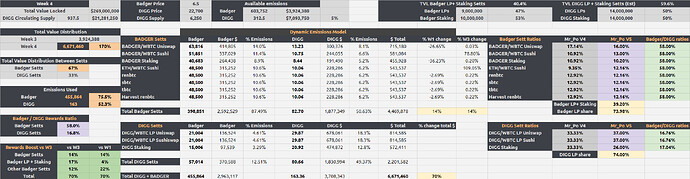

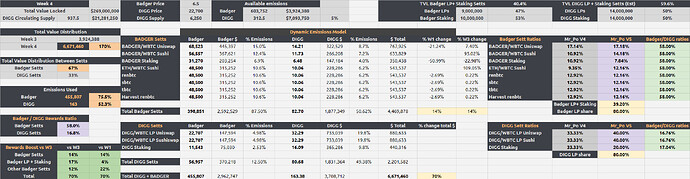

If you could get 600% APY for mining Badger and 400% for mining DIGG would you still mine DIGG to get the rewards?

It is less of a structural question and more of a balancing act, in my opinion.

And the most reliable way to balance is by having 50/50 Badger/DIGG rewards ratios.

Otherwise if Badger’s price decreases, people will have a financial incentive to exchange it for DIGG to mine DIGG Setts for better APYs, thus decreasing the Badger’s price even further.

Having 100% DIGG rewards for DIGG Setts and 75/25 Badger/DIGG ratio for Badger Setts presents an extremely problematic situation for Badger token holders.

Following the logic you’ve presented above, if people think that 1 DIGG is 1 Bitcoin (and more), and Badger is a token with no real value, why would they prefer to mine the Badger Setts over DIGG Setts?

==

Continuing my previous thoughts from before, there is an easy way to solve for the difference in the APYs - the 50/50 split in ratios.

An alternative way would be to further cut the emissions of DIGG.

Having Badger focused rewards for Curve BTC Setts is also not necessarily a good thing for Badger holders.

BTC Sett miners are more likely to farm & dump - while, for example, Badger stakers are more likely to stake & restake.