Honestly badger’s holder who didn’t sell should get more digg than sellers who dumped badger price.

agreed. let’s meet some deadlines n shit lol

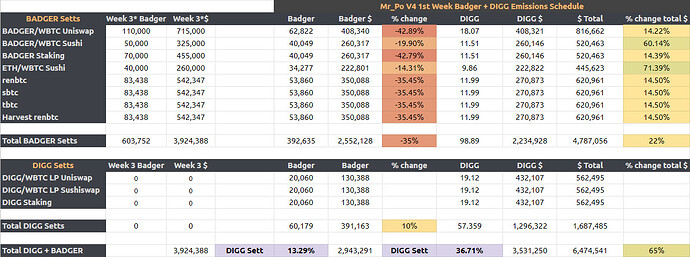

Building a sheet that might be useful going forward instead of the quick one I put together in response to this proposal. Once done, I’ll look to share it out.

Traders who trade seek the best lp to trade in. As long as the uniswap pool doesn’t route via wbtc, simple traders aren’t even using the pool we have setup. Part of supporting DeFi is about supporting a truly decentralised ecosystem. Spreading liquidity around different AMM’s and training users to use aggregators like 1inch and matcha is the right direction to go.

We only get 1 chance at launching this. If it’s tomorrow, 3 days after that or a week it doesn’t matter. What matters is community participation and sound reasoning behind decisions.

The only thing that jumps out to me is the lack of increase in rewards for CRV sett users. They represent 80% of our TVL and also all of the revenue for the DAO. We need these to be the healthiest returns. I’m not convinced that they would be happy with a 40% decrease in Badger rewards to now have that made up of DIGG. We may want to treat those slightly different.

Maybe decrease Badger emissions on Badger only and some of the DIGG pools?

The thoroughness of this proposal is impressive and thank you for all the mind power you put into this.

My concern with it is that we have the same Badger emissions as previous week (it would be ideal to reduce those to extend LM), I think DIGG is too high still and DIGG pools receive too much Badger.

I don’t think we should decrease badger rewards for badger only pools. It’s better to take it off digg pools. We should keep rewarding badger holders and stakers.

hmmmm…I had not considered paring down the badger emissions but included it at your suggestion. I also decided to use a few more possible data points in my proposal and tried to bring this version closer in alignment with @Mr_Po 's great work. *Please take note the numbers keep changing as the value of Badger and BTC fluctuate.

- Reduced Digg emissions to ~51% of the original plan. The value of airdropped DIGG is estimated to be $22M therefore the total value with a 100% conversion to a sett is ~33M (combining with wBTC in LPs). With emissions of ~1.62M/week equals 330% APR between Badger and Digg rewards.

- Reduced overall Badger emissions 14.7% which can be reduced further in future weeks as Digg emissions should scale-up

- Kept numbers balanced and in proportion where it made sense to do so

- Increased APY across the board although lowered that prior versions for BTC setts but this can be tweaked by adding more DIGG

- Plenty of surplus Badger and Digg to deploy for the remainder of the LM program and longer if decided upon

Unlimited Power Badger + Digg Week 1 Emissions Proposal v5

I like your reasoning, especially when you remark that DIGG is totally separate value proposition. This is why I would be very careful with DIGG rewards. I wouldn’t like to see people holding on to their Badger because they believe in the DAO, and dumping DIGG (or use it mostly for speculation). A good balance is necessary.

I would also reduce (as per the proposal) the DIGG emissions in week 1 and potentially incentivize / reward longer term DIGG staking / LPs (probably increasing emissions / multipliers).

Totally agree with this. Reducing the Badger emissions on the Setts and the Supersett is against the interests of the DAO.

I also agree that rewards on the Badger-only pool can be reduced and that DIGG pools should get Badger but not too much - as mentioned before totally different value proposition.

Why reduce from the badger only pool? That’s unfair when the badger pool consists of people who have been in the beginning and who believe in the success of the DAO. Badger from Spadaboom’s announcement will both be a governance and value token in the sense that fees from all setts will be given to Badger stakers. Digg is a value token and should stay as that. As the DAO progresses, we can use profits from DIGG to do buyback programs of Badger therefore raising the price of badger. This is $BADGER DAO, not $DIGG DAO. remember that. if you start making DIGG more important than $BADGER then what’s the point of it being $BADGER DAO… It could be balanced between the two, but I believe that we should emphasize more importance on holding $BADGER as it’s both the governance and value token of the protocol.

By raising the price of $BADGER, the 40% in the treasury which will be controlled by $BADGER holders will be very valuable and can be used to further the protocol.

Ok.

Digg has a simple to understand value proposition (algorithmic synthetic BTC). So one digg should be worth 1 btc.

Badger DAO is far harder to value. Its value accrues from managing products. So value should accrue from the products it manages.

So: DIGG should be DIGG

Badger should be everything Badger creates.

What I’m saying here is I will continue to mine Badger as I’m getting DIGG (and I really want digg as that’s very valuable). But if I could get DIGG and Badger by mining DIGG I’ll do that instead.

By not giving Badger automatically with DIGG mining we are protecting the value proposition of Badger. Otherwise people will just mine new products.

I agree with bberry259. Let’s not incentive DIGG mining with Badger rewards. #protect BADGER

I think you misunderstood me completely, to be honest. Why reduce from the Setts instead? It is all about achieving the right balance. That’s all. And I believe Badger holders should also be staking Badger AND using the rest of the products (Setts) - this is a win-win.

I barely mentioned Digg and I am not making it more important. On the contrary, I am against Digg getting too much Badger, exactly because of what you say. We are in agreement there.

Here’s an option to consider:

I agree that BTC-only Setts shouldn’t be underincentivized comparatively.

So I’ve tried to normalize the overall increase in rewards for all Setts.

The Sushi Badger/WBTC Sett is rewarded on the same level as Badger Staking Sett.

And ETH/WBTC Sett is rewarded a bit less, as it is 50% ETH.

I’ve also adjusted the Badger/DIGG rewards ratio. Curve BTC Setts get 56/44 currently, other Badger Setts are around 50/50.

I’m not sure if a further decrease in Badger emissions for DIGG Setts would gain us much.

Since V3, DIGG Setts get only 13.29% of Badger emissions (it was 25% in V1/V2). And the Badger/DIGG ratio of DIGG Setts rewards is not high: it’s 23% already - and would get to 20% if Badger price would drop to 5.5.

I start to have some reservations about changing the Badger/DIGG ratios and how it might play out in reality. I get those from seeing how the model reacts to price changes.

I can imagine some realistic and unpleasant spiral effects that could come from that adjustment.

I’m leaning towards thinking that the safest play would be to go with 50/50 Badger/DIGG rewards for all Setts - at least for the first week, when we can expect a lot of volatility on both Badger and DIGG.

A lot of the numbers in sheets got quite fragile compared to V1/V2 models.

My main objective was to normalize the expected APYs for Badger and DIGG Setts.

It is a much more stable and controllable construct when the APYs come 50/50 from Badger/DIGG emissions.

I’ll dig into that a bit deeper and come back with V5.

Meanwhile, I have a question to ask.

- 100%

- 90%

- 80%

- 70%

- 60%

- 50%

Thanks for this @Mr_Po. Just to confirm. Those numbers are based on those informations ?

Yes, those numbers are based on the numbers you’ve mentioned. They are used as total available emissions.

Historical data largely supports the idea of doing prolonged liquidity mining programs.

Using 75% of available Badger emissions and 50% of available DIGG emissions for week 4 of BadgerDAO incentives allows extending the liquidity mining program beyond 8 weeks while still providing a considerable boost to the total amount of value distributed.

Last time I checked, the overall estimated value BadgerDAO Sett users would get with this emission model is 65% higher than week 3.

Fair . Badger must stay the king