This has been revised and combined with the related DIP. The new proposal is here. Please vote at the following link: BIP 92: Digg Restructuring (V3 / Revised)

Category: Boost

Proposed by: @Live4soccer7 (let me know if you want in here)

Scope: For the purposes of boost, make DIGG count 1:1 relative to the value of Bitcoin whether DIGG trades above or below a 1:1 BTC peg

Objective: Regain DIGG to BTC Peg with minimal impact to badger holders

TLDR:

- DIGG has not maintained a 1:1 peg to bitcoin and it is currently trading at a 40% discount to the price of BTC.

- The purpose of this BIP is to incentivise 1:1 rebasing of DIGG by making it count as boost as if it were actually pegged 1:1 to BTC

- This allows investors to purchase boost at a discount (currently 40%)

- This should increase market demand for DIGG and reduce or eliminate the discount at which it trades to BTC. Ideally it would return DIGG to a 1:1 peg.

- This BIP will only be passed and valid if DIP 4 (Turn off Positive Rebasing) is passed.

Considerations:

- BADGER holders may sell Badger to buy DIGG resulting in sell-pressure on the BADGER token

- It is estimated that this change would inject ~$7.4m into the value of all boosted native tokens. This would dilute existing BADGER boosted wallets with this new boost going to DIGG holders.

- The boost impact to existing BADGER boosted wallets is estimated to be a reduction of ~8% (eg. 10% becomes 9.2%)

- DIGG whales could dump before this is implemented, depressing the price, and then they could buy back lower to scoop cheap boost.

- After peg, badger pulls 75% of the TCL, return the BTC to the treasury, and burn the DIGG, therefore reducing total long term boost

Background:

DIGG is an audacious and experimental product tackling one of the hardest problems in DeFi: how an uncollateralized asset can achieve stability against a price target (hereafter “peg”).

While its ancestor AMPL targets a fixed price level, DIGG’s job is even harder because it seeks to track the price of BTC, a highly volatile asset.

Given the difficulty of the problem, rapid experimentation and iteration is needed to ensure that DIGG can grow and find a niche within DeFi.

DIGG has been up and down since inception and held peg for a while in Q4 of 2021. It has since fallen from peg and has been consistently falling. There are talks of DIGG moving towards being a fractionally backed BTC asset. The platforms that could create such opportunities are young and this will take a lot of time and development.

This strategy is meant to help bridge the gap and keep DIGG sustaining while the backing behind DIGG gets fully developed and implemented. Providing a 1:1 boost regardless of DIGG’s peg ratio gives it meaningful value and is expected to drive it back to peg and hold it there. This also demonstrates that DIGG is still actively being looked at and worked on.

The decision to also remove the positive rebase will help keep the DIGG marketcap down in relation to badger token’s marketcap so that it has a minimal impact on rewards that are emitted to badger token holders. If DIGG were functioning properly right now then this proposal would have no effect on badger token holders’ rewards, but it is not and that is why an adjustment is necessary.

Low Level Details:

There are concerns of how this will impact badger holders’ rewards, so this is aimed to try and show the impact.

Details taken on 2022/04/13 03:09 UTC

Total Supply: 520.98448791

Treasury Control: ~56.5

Non-Badger controlled supply: 464.4844

DIGG market capitalization with DIGG at 0.611:1 BTC = 11.8M. (DIGG @ $25,326)

DIGG market capitalization with DIGG at 1:1 BTC = 19.2 (BTC @ $41,413)

DIGG market capitalization DIFFERENCE = 7.4M

Current Badger market capitalization is 91M. (Badger Token @ $9.14)

If DIGG was solely brought to peg by badger holders selling badger to buy DIGG for boost at a discount then it would drop the badger market capitalization 7.4M, resulting in a total market cap of 91M, which means that badger token still retains approximately 91.9% of its market capitalization in this worst case scenario. It is expected that some will take advantage of this arbitrage opportunity, inevitably. This also demonstrates that badger token holders will still retain their dominant collection of badger emissions over DIGG holders. DIGG would comprise less than 25% of badger DAO’s native assets. It is also expected that DeFi users who would not take the risk will buy DIGG with value and stability behind it, therefore helping the overall badger platform and diversifying badger token holders to those that may have never received badger tokens prior to boost.

Worst Case Scenario

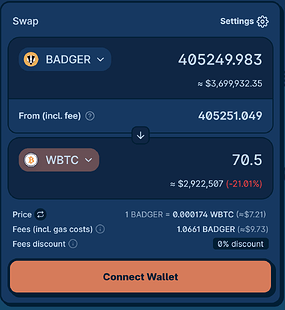

Due to liquidity, if DIGG was returned to 1:1 peg value 100% from badger token sales within a very quick period, let’s say 1 day, then the following could theoretically happen. It currently takes about 70.5 wBTC to return DIGG to peg via cowswap

To obtain 70.5 wBTC via selling badger purely on cowswap it would have an 21.01% drawdown on Badger price.

NOTE: The above example is what has been portrayed as an absolute worst case for the badger price given that DIGG was brought to peg completely from badger holdings, which is extremely unlikely. It is up to the open markets as to where the funds for DIGG, to bring it back to peg, will come from.

The DIGG supply can not be expanded from rebasing, so this is a one time event. The 1:1 boost provides that incentive to keep peg. It is believed that this will create a “stable boost” which may attract a lot of attention to DIGG if people are able to get it on rare incidents where it falls below peg, creating an environment where you would be fortunate to hold DIGG due to its stability. The only way more DIGG is introduced to the market is through emissions that the badger DAO votes for regarding DIGG.

Business and Technical Requirements:

- A communications effort from the Bager / DIGG communities would be required to educate users and build support (~1 week of comms time)

- It is not anticipated that this change would affect the composable form of DIGG (bDIGG) so there is no need to alter partner smart contracts

- Is it anticipated that minimal dev work (½ day estimate) is required to implement the change(s)

- Yes, give DIGG 1:1 boost with BTC value regardless of PEG (DIP3 pause rebasing has to pass)

- No, do not give DIGG 1:1 boost and stop DIP3 from passing