Category: Emissions.

Scope: Add ibBTC/WBTC SLP Sett to the general emission schedule with a 1.5x multiplier.

Status: https://snapshot.org/#/badgerdao.eth/proposal/QmQgwtAqhBYAvmPQRbBzALtRiZCUv4wkCxAPPbrB5u5ayJ.

TL;DR:

- Add ibBTC/WBTC SLP Sett to the general emission structure with a 1.5x multiplier.

In combination with the Launch Boost it would keep the rewards for the Sett at around the same level as they are now, during Phase III of its Guarded Launch.

Overview.

With the ibBTC guarded launch phase coming to an end, it’s time to integrate the ibBTC/WBTC Sushi Sett into our general emission structure.

Currently, byWBTC Sett has a 2x multiplier, renBTC and ethBTC Setts have 1x multipliers, and tBTC and sBTC have 0.5x multipliers.

I suggest adding ibBTC to that structure with a 1.5x multiplier.

With the standard 2.5x launch boost (BIP 57) it would mean that the rewards in the following week for the Sett will be at a similar level to the current week.

The updated emission schedule with the change is available in this sheet.

Specifics.

For the third phase of ibBTC guarded launch the Badger Council approved spending 10500 Badger and 2 GDIGG as weekly rewards to ibBTC/WBTC SLP Sett.

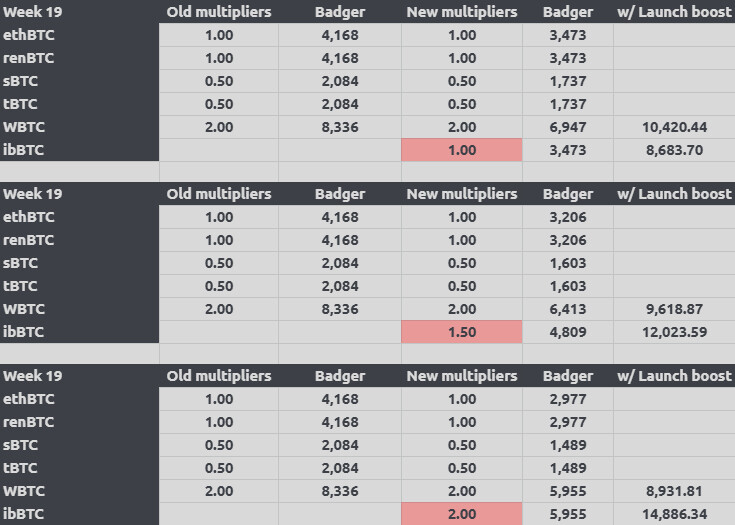

Incorporating the Sett into the emission schedule with a 1.5x basic multiplier and a 2.5x launch boost would put the rewards for the Sett at 12,023 Badger for week 19.

Here’s how incorporating the Sett with different multipliers affects the rewards to non-native Setts:

The more detailed info on how this change affects the emissions for the next month is available in the sheet.

- 1x

- 1.5x

- 2x

- Other

One thing worth mentioning is that the ibBTC/WBTC SLP pool also receives the rewards of the tokens that it has been minted with.

So for example, if byWBTC had 4% APY in Badger rewards, that would add 2% APY into the ibBTC/WBTC SLP pool.

This, however, would change to the benefit of SLP Sett depositors if ibBTC travels cross-chain and participates in other liquidity mining programs.

Implementation.

If approved by the governance, the changes can be implemented with the following emission cycle on Thursday.