GOAL

A SETT that automates the actions of a rational profit driven holder of $DIGG; providing stability and upside for the holder, fees for badgerDAO, and price support for DIGG.

Abstract

Rebasing assets are built on the assumption that price can be influenced by adjusting supply. Create more supply and holders will sell some, reduce supply and they are more likely to hold. The more that participants follow this rule the more stable the asset should become. This SETT strategy is meant to mimic the actions of the ideal holder, selling as more supply is minted and buying as it is reduced.

Benefits:

- Diversification through holding both DIGG and WBTC

- Users save on gas since the SETT as a whole rebalances vs each user doing it themselves

- DIGG is stabilized, as price moves upwards there is steady sell pressure and steady buy support on the way down

Description

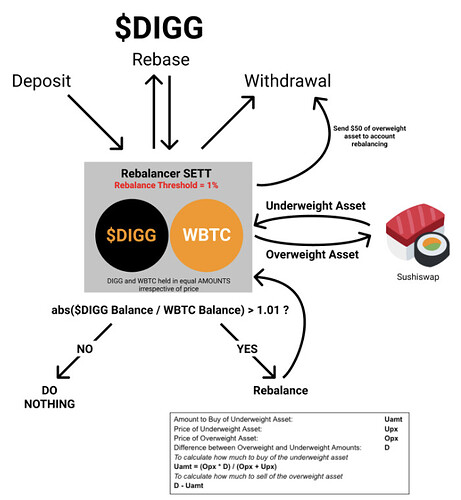

A sett that holds an equal number of DIGG and WBTC tokens. If it holds 1 DIGG it should also hold 1 WBTC, irrespective of price. It will have a stability threshold (ex 1%) that it will use as the rigger to rebalance.

There are three external ways in which the supply of either coin can change.

- User Deposits

- User Withdrawals

- Rebase

On each of these actions the Sett will check and see if the action will take it beyond the stability threshold (either way) and if so it will rebalance back to the stability threshold.

Rebalancing

You can find the amount to buy and sell for rebalancing using the relative prices of the two assets and the gross difference in the amounts held in the SETT

- Amount to Buy of Underweight Asset: Uamt

- Price of Underweight Asset: Upx

- Price of Overweight Asset: Opx

- Difference between Overweight and Underweight Amounts: D

To calculate how much to buy of the underweight asset

Uamt = (Opx * D) / (Opx + Upx)

To calculate how much to sell of the overweight asset

Oamt = D - Uamt

Mechanics

On each action listed above (deposit, withdrawal, rebase) the difference relative to the threshold should be checked and, if appropriate, trigger the rebalance. Anyone calling the rebalance can be rewarded with $50 in DIGG in whatever the overweight asset is at that time for their trouble (and gas).

Ideally the rebalance can be called by the rebase contract directly. If not, hopefully the incentive will be enough to inspire prompt rebalances.

Fees

Standard fees can apply, my preference would be for a deposit fee that would reward those that had been in the pool longer at the expense of new entrants (.5% seems appropriate).

Performance

It will be difficult to determine a benchmark to compare against to determine “performance”. We can leave performance fees as 0. In lieu of this a small fee could be taken on each rebalance.

Other Thoughts

- The SETT could hold DIGG and a different b-SETT (brenCRV SETT) token instead of WBTC to get the benefit of the yield inherent in the SETT. The amount compared to the balance of DIGG would be adjusted by the brenCRV<>WBTC price. More complicated, but not impossible.

- Lockup periods or other incentives (rewards multipliers through staking) could be added to really improve stability

- This is only possible due to the existence of the SETTs. It is simple but still a novel concept. It could have limits on the amount of deposits it can receive to limit the potential downside.

- Ideally the rebalance function can be called on rebase. if not then that may need to be looked at more closely.

- It may make sense to have a larger rebalance threshold to start (5+%) and then reduce via governance (if possible) over time

Conclusion

This SETT could be a differentiator and be a key piece of DIGG being the most successful rebasing asset to launch to date.