Let’s get it started, however I wish there is alternative to Uniswap, just saying. Can’t wait till lunch.

I really like where you are going with this and believe this is a better overall structure for emissions in week 1.

What I like and agree with.

-

Using the blend of $$ value from both assets to achieve an APY benchmark. This allows us to extend emission distribution for greater period since less of each is distributed weekly.

-

Reducing the amount of DIGG emissions in week 1. I agree that it doesn’t need to be 10k% APY and that could be problematic. That attracts certain types of depositors and argue that many of those people would dump $DIGG as they get it. Could increase the likelihood continuous negative rebases. Having 500-1000% would attract more of the right people and still plenty of TVL. Similar to @UnlimitedPower proposal which I think its good as well.

Potential Issues

-

With the 50/50 badger/digg reward ratio we assume stakers in those setts see the same value from earning both of those assets. I don’t think this is the case. I would argue those earning Badger today have a certain belief around the DAO’s future potential and intrinsic value in governance tokens. Where DIGG is a totally separate value proposition and potential user profile.

-

We are overlooking what users do with the assets they earn. Although incomplete data, it suggests those that earn badger restake in the badger only or badger UNI LP pool. If they are earning much less of one asset compared to before it could deter existing stakers from maintaining their position.

-

This assumes DIGG price is close to Bitcoin. Obviously the intention but not guaranteed it will be there right out of the gate. Lots of other factors in play. This presents a potential problem if DIGG is much lower than Bitcoin, the return $$ total would be quite a bit different than week 3. Which could increase the chance of TVL leaving.

How We Could Potentially Improve This Proposal

- Adjust 50/50 reward ratio to 75/25 for the respected vault types. Ie 75% of total value received in renbtcCRV sett is in Badger. Where 75% in DIGG UNI LP sett is DIGG.

This assumes we still have an increase in % change total $ per sett, reduce total amount of Badger distributed this week vs week 3 and lower DIGG emissions week 1.

Thoughts?

Using the following assumptions:

- Badger is $8

- Digg is the price of 1 BTC

- Week 1 emissions will be ~65% of the original proposal (202.6 Digg versus 312.51)

I think it is difficult to get to the golden ratio of 75/25 given (if Digg holds close to BTC peg) given the disparity in the price of the rewards being emitted using those assumptions. I’ve attempted to run the numbers in my spreadsheet and unless the price of badger increases quite a bit its quite difficult given the constraints of supply and price to get to 75/25 and increase APY for all setts. The latest version I presented gets to about 75/25 for Digg but only to 60/40 Badger to Digg on the Badger setts. BTW, I do think we need to start slowly at launch as this is very much novel ground so we should tread carefully and as any competent military commander will tell you we need keep something in reserve to make tactical battlefield adjustments and that is the one of the reasons I suggest starting with a lower emissions rate.

Adjust 50/50 reward ratio to 75/25 for the respected vault types.

A totally reasonable adjustment and valid arguments behind it.

I was focusing on other parameters when making the sheet, it’s not like I consider 50/50 optimal.

75/25 makes perfect sense.

i was trying to state something similar to what @DeFiFry said here:

there is a lot of discussion happening around the specifics of $digg launch which is very important but ultimately the users of badgerDAO just want $btc yield. so rather than posing a question, i was looking for feedback on keeping badgerDAO wrapped $btc $crv vaults incentivized through emissions instead of giving huge incentive to $digg lp vault. don’t want to get lost in the weeds, just trying to bring up the perspective of newbie users

This is simply not an option. Most people use Uniswap. It is the most known platform and arguably easiest to use, definitely easier than Matcha and 1inch. We need uniswap. We need masses, lots of people in order to be a succesful platform.

Its a difficult proposition to keep APYS elevated as TVL increases (which we like) and price or supply does not increase with it. To exacerbate the situation it the addition of more pools to stretch that badger supply over, ie. Sushi and Digg LPs. This is where the Digg release helps quite a bit and adds another token to the rewards to boost the APY on all setts and something we are attempting to figure the optimal levels and structure for.

that makes sense and i support where we are going. thank you for your input @UnlimitedPower the intention of my comment was to center the zeitgeist of badgerDAO around being almost like a decentralized blockfi (and obviously so much more) ethereum’s one stop shop for yield on tokenized $btc

Matcha and 1inch just route, the liquidity is provided by Uniswap - where BADGER/WBTC liquidity providers take all the risk. Just because you don’t like the protocol, you can’t punish LPs.

High slippage is due to decreased liquidity, which would absolutely tank if you took their rewards away.

i really like that $badger/$wbtc uni pool has highest $digg emission and increased $badger in this update. i’ve been thinking about what will happen to $badger if everyone removes liquidity from the $badger/wbtc to deposit into $digg/wbtc

There have been some great points brought up here. I also understand and agree that building TVL through real liquidity is necessary with asset pairs. I just hope in finding that balance we can continue to provide a competitive APY for the single asset Setts, even if it isn’t as much as the others. The level of discussion here leaves me with no doubts.

This will be the final version from me using 75% of the Digg emissions of the proposed launch emissions taking into consideration all the statements I and everyone else has made, well at least from my pov ![]()

- Balances both Sushi and UNI setts for WBTC/Badger

- Balances the DIGG and BADGER only Setts at 50% of the combined SUSHI + UNI Badger LPs

- Balances rewards across all Badger Setts

- Starts DIGG Setts off with high APYs without flood the market with something too high since airdropped DIGG which will essentially act as the seed for LP and DIGG only sets

can you share this as a google spreadsheet?

So taking from the Badger sett more? Or?

very true. we want traders who trade

on potential issues:

i agree that while $badger and $digg are symbiotic they are different user profiles and i don’t think many others in the community are thinking about this yet

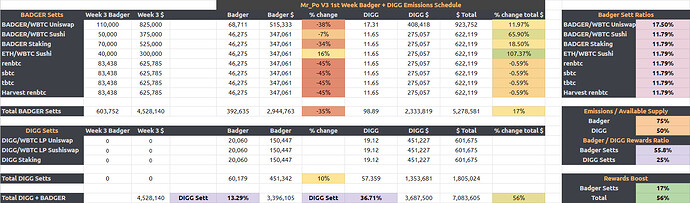

Mr_Po DIGG + Badger Emissions model V3

The main change is in the adjustment of the Badger/DIGG reward ratios.

Previously it was around 50/50 for both types of Setts. In the new model it is:

- 56/44 for Badger Setts*

- 25/75 for DIGG Setts.

The rewards stay the same, you just receive 56% of your rewards in Badger and 44% in DIGG while being in the Badger Sett.

Badger Setts are still the best place to earn Badger, and DIGG Setts become the best place to earn DIGG.

*A further adjustment towards the mirrored 75/25 ratios would require the change in emissions: increasing Badger emissions and decreasing DIGG’s.

I don’t find it too viable, though, as I think that the original 75%/50% Badger/DIGG emission schedule does a better job at prolonging the BadgerDAO’s initial liquidity mining program in a balanced way.

==

The sheet above presents a method for defining Badger and DIGG Sett emissions.

The main thing I’ve optimized for was keeping Badger and DIGG Staking + LP rewards close to each other while giving a small boost to the current Setts.

The boost is +17% at the current + projected prices and is subject to change due to price volatility.

The structure of the emissions in the method is not price dependent, though. The $ prices are there for reference and reality check.

- Yes

- No

- Neutral

- Not sure

I dont think Digg setts should automatically get any Badger. Badger DAO can decide to do events and add some for a period of time.

Digg should be digg only.

Badger should get allocation of any new product but not by reducing the amount of Badger.

Providing some reasoning would certainly help.

As if there is a valid reason for this change, it is not self-evident (to me at least).

It is a change to all the models presented.

And it looks like a big shift to the principles by which BadgerDAO has operated so far.

Badger token is a governance token that controls DIGG treasury and decides upon which DIGG Setts are incentivized and how.

Distributing governance rights to DIGG holders and DIGG Sett users makes sense from the interest alignment standpoint.

The same logic applies to other future BadgerDAO products: I see no valid reason to disenfranchise product users from governing the DAO.

I would prefer to invite them to govern by allocating part of Badger distributions to them.

It’s great that everyone can join this fruitful discussion, however, it takes too long before it gets to the conclusion. If we change any ETA for the action, we should clearly set it. If not, we should get these discussions concluded before the deadline. Let’s do so next time.