@mason brought up a really good topic to discuss that I’ve had my reservations about since before the Badger launch: the comparative underincentivization of liquidity locked in LP pools.

This matter might be especially important in the context of the DIGG launch.

The metric I suggest to consider adjusting is the reward per DIGG/Badger pooled within the program.

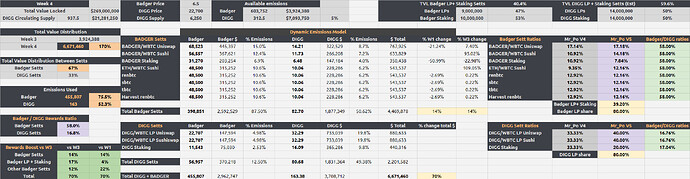

Here’s how distributions would look if we were to reward the same amount for Badger and DIGG per liquidity pooled: