Background

Historically, the Treasury’s policy has emphasized maintaining upside exposure of its crypto assets.

When the Treasury ran out of Stablecoins, it first reduced the Stablecoin holding requirement from one year to 3 months via TCD 46.

Then, a few months later, it began borrowing Stablecoins against BTC & ETH to fund the runway needs (TCD 70) to avoid selling.

While these two TCDs have significantly extended the DAO runway, the borrowing strategy has its limitations, and I believe it’s no longer prudent to use it.

The limitations are capital inefficiency and liquidation risks, whether these manifest in liquidation itself or the need to sell assets at lower prices to prevent it.

Also, since implementing the borrowing strategy, the Treasury has had to deploy 34.84 WBTC to BADGER/WBTC Treasury Controlled Liquidity (BIP 74, TCDs 79, 83).

Depending on BADGER holder behavior, the Treasury might also need to deploy another 17.43 WBTC to TCL.

In the scenario where these positions get filled though, the Treasury would own 100% of BADGER supply via TCL.

Due to BTC liabilities to BADGER holders related to TCL (both potential and fulfilled), the asset composition available to fund runway needs is skewed towards ETH.

The Compound position has accumulated $2.8M in debt, and I believe the risks now outweigh the benefits of this strategy.

Thus, I propose to:

- Stop borrowing against Treasury’s crypto assets and instead sell ETH or BTC to Stablecoins as needed per TCD 46.

- Close the Compound position using ETH for repayment.

Decision #1: Sell for Runway Needs instead of Borrowing

Based on the latest Treasury snapshot with ETH price at $4,700, the Treasury holds $11.3M in assets against $2.8M in liabilities.

This gives us about 4:1 asset-to-liability ratio.

With the $2.4M yearly burn rate, it will take a year for that to reach 2:1 ratio if prices stay the same.

And at that point, a 50% price drop would liquidate the Treasury Runway funds.

Continuing with the borrowing strategy implies reliance on sustained price increases.

Without this, accumulating debt will eventually reduce the CR enough to force the Treasury to sell collateral at lower prices to keep the position healthy - or face the risk of getting liquidated.

Thus, the proposal is to stop borrowing against ETH/BTC for runway needs and instead sell ETH/BTC as needed to maintain the 3 months Stablecoin runway.

Decision #2. Close Compound Position Using ETH holdings

The risk/reward of keeping the Compound position on is unfavorable.

Here’s how the Treasury performs in two scenarios:

a) where we close the Compound position using 600 ETH

b) where we keep the Compound position open

ETH -50% Scenario

In the scenario where ETH is down 50%, with the Compound position closed, the Treasury would retain $5.8M in liquid assets.

With the position open, the Treasury would have $4.4M net assets (25% less), comprising $7.2M in assets and $2.8M in liabilities.

With a 200% CR target, $5.6M would have to be locked in Compound, leaving only $1.6M in liquid assets to fund the runway (assuming the debt is not increasing).

$1.6M is 8 months of runway at the current burn rate, after which the Treasury would need to at least partially close the position at lower prices to free up the funds while maintaining a healthy CR.

ETH +100% Scenario

On the other hand, there isn’t a significant difference in outcomes for the DAO when the Compound position gets closed and ETH runs up +100%.

In both scenarios ($14M vs $17M) the Treasury will have enough funds to maintain several years of runway to build the new product - and also to bootstrap it.

So what we’re risking here is having less funds for bootstrapping incentives, but these funds are meant to be spent in 2-3 years, and whatever they’re worth will depend much more on BTC/ETH price at the time.

So overall, I believe the utility of having more liquid funds in the negative scenario far outweighs the utility of having slightly more funds in the positive scenario, and thus the proposal is to:

- Close Compound Position using ETH collateral.

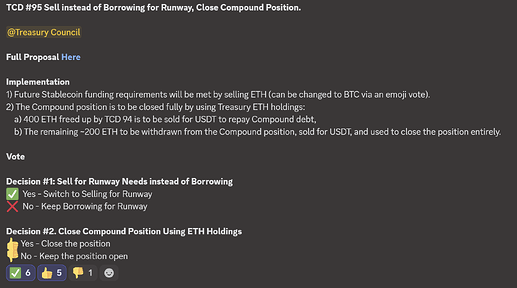

Implementation

- Future Stablecoin funding requirements will be met by selling ETH (can be changed to BTC via an emoji vote).

- The Compound position is to be closed fully by using Treasury ETH holdings:

- 400 ETH freed up by TCD 94 is to be sold for USDT to repay Compound debt,

- The remaining ~200 ETH to be withdrawn from the Compound position, sold for USDT, and used to close the position entirely.

Vote

Decision #1: Sell for Runway Needs instead of Borrowing

- Yes - Switch to Selling for Runway

- No - Keep Borrowing for Runway

Decision #2. Close Compound Position Using ETH Holdings

- Yes - Close the position

- No - Keep the position open