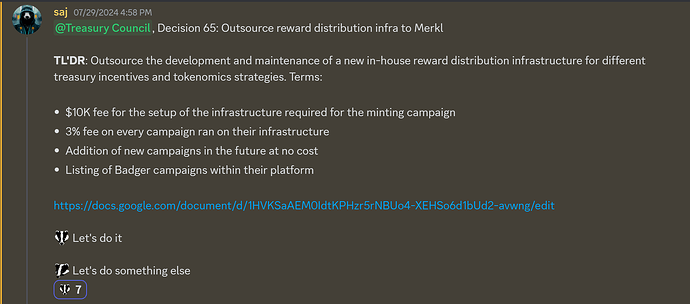

TLDR: Outsource the development and maintenance of a new in-house reward distribution infrastructure for different treasury incentives and tokenomics strategies. Terms: $10K setup fee + 3% on every campaign.

Background

Historically, Badger has developed and maintained different tools for the distribution of in-house rewards/incentives. This brought a better UX to protocol depositors looking for yield opportunities at the expense of very high development and maintenance costs.

With the eBTC launch and the end of the minting incentives rewards rounds provided by Lido, the treasury is contemplating continuing a minting incentives program and perhaps look into the setup of other more sophisticated incentives strategies. This and new campaigns will require, once more, of an advanced, accurate and real-time distribution system.

Proposal

As opposed to devoting internal resources to the development and maintenance fo a new distribution framework, it is proposed to outsource this work to Merkl, a protocol and team that branched off of Angle Labs. Merkel is specialized in the kind of infrastructure that is required to meet the Treasury incentives needs and has made the following offer to the council:

- $10K fee for the setup of the infrastructure required for the minting campaign

- 3% fee on every campaign ran on their infrastructure

- Possibility of addition of new campaigns in the future

- Listing of Badger campaigns within their platform

Additional details around their product:

- Rewards are distributed every 8 hrs (cycles)

- Full integration within Badger/eBTC’s UI (claiming)

- API returns up to date APR and amount values for UI integration

- This means that apart from being listed on their site, users can interact with the infra fully from the Badger/eBTC app

Metrics of Success

How long will the investment thesis take to play out?

Not an investment

Will the treasury recoup funds or does the investment represent an outlay?

Outlay

What are the risks associated with each investment?

- Protocol risk (0 - 10): Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

<3>: Their system consists on a series of very simple Smart Contracts audited in C4. They haven’t faced any exploits nor known risk events. In case of an exploit, the amount lost will be limited to the total value emitted in the last period (week/bi-week/month) which should never be large enough to represent a meaningful damage to the treasury. User funds do not interact with Merkl.

-

Other integrations: https://docs.merkl.xyz/merkl-mechanisms/types-of-campaign

-

Liquidity risk (0 - 10): Liquidity risk refers to how easily an asset can be bought or sold in the market.

<0>:

- Execution risk (0-10): How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

<3>: Once the payment of the setup fee is completed, they forecast a 2 week period required to complete the work.