Category: Emissions.

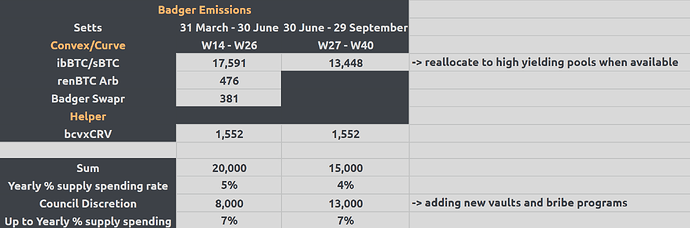

Scope: Badger emissions between June 30 and September 29, 2022 (Q3).

TL;DR:

- Keep bcvxCRV emissions at the Q2 level.

- Stop Arbitrum emissions.

- Complete currently running Council-approved graviAURA bootstrapping emissions as scheduled.

- Reallocate 5,000 Badger/week from ibBTC to future use at the Council’s discretion.

- As higher yield vaults become available, reallocate emissions towards them through a public RFF and Council approval process.

Overview & Specifics.

Lots of things are in motion at Badger as we enter Q3.

Gravity and its new graviAURA vault offer many interesting opportunities to build on top of Balancer. The model of charging a fee on vote weight also creates a different way of thinking about revenue and delivering value to the token holders.

Currently, the ibBTC vault is offering no underlying yields, and the DAO is emitting a lot of BADGER there without taking in any fees, and it’s a similar situation with Arbitrum vaults on a lower scale.

The general direction of the BIP is to reduce emissions until we launch the vaults with underlying yield where emitting is more promising.

Emissions and the Badger Boost system are an important part of our tokenomics, and Q3 will bring a number of new products where these concepts can be applied and evolved.

As new vaults with higher yields become available, the DAO will work with the Badger Council (and in public RFF) to move emissions from ibBTC to higher-yielding vaults.

On Bitcoin Yields:

The state of the Curve + Convex yield influence market, together with the structure of the LPs, currently doesn’t allow us to have BTC-heavy pools with sustainable yields. This is due to our inability to cost-efficiently incentivize enough CVX voting for the AUM that seeks yield in a single-sided BTC pool.

We need to do a bit more work to figure out how to make graviAURA work well with stableswap pairs, but once we do, there will be opportunities to create pools that are mostly BTC and have relatively little IL against graviAURA that should yield and scale quite well.

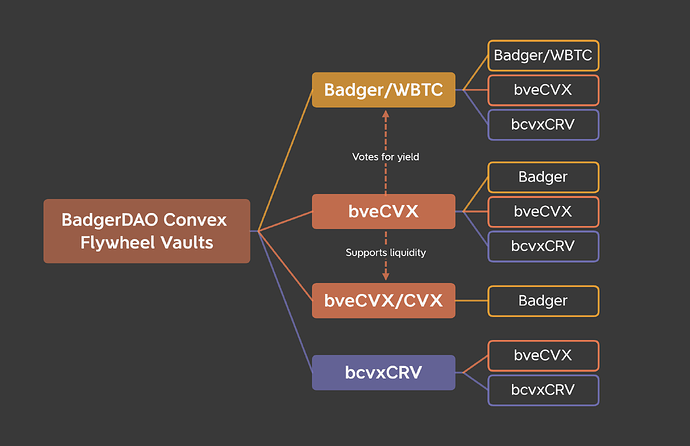

On Curve + CVX Flywheel:

In the Convex + Curve ecosystem, the goal is to keep the flywheel that is rolling, where we have a Badger LP and bveCVX as native assets in the Boost, and the Boosted rewards on bcvxCRV:

The flywheel keeps performing well, so no change is proposed to the bcvxCRV emissions.

Leaning on the Badger Community Council:

The final pools and allocations would be subject to change and would need to be approved by the Badger Council. The Badger Council’s membership is ratified by BIP-86. Its mandates beyond these decisions are currently awaiting sufficient forum votes to move to snapshot in BIP-93.

Due to a lot being in flux and otherwise reduced emissions, it is proposed to increase the Council allocated budget from 8,000 to 13,000 BADGER per week. Note that in Q2, the only Council decision to allocate said Badger involved up to 25,000 Badger allocated to bootstrap graviAURA in a one-time event. This event will run into July.

On budgeting:

This would bring:

- the base rate of weekly supply spending of BadgerDAO to 15k Badger/week (4% yearly supply spending rate),

- 20k Badger/week during the graviAURA bootstrapping event, or 5% yearly supply spending rate,

- Up to 28k Badger/week, or 7% of yearly supply spending rate if all the budget under the Council discretion is used.

The cap on the emissions budget would be the same as in Q2.

Our direction with emissions is to stop incentivizing vaults that bring minimal revenue to the DAO, and the primary recipient of cost-inefficient emissions is the ibBTC vault on Curve.

On Arbitrum:

The Arbitrum ecosystem doesn’t have many yield opportunities at the moment, with minimal yields on Curve and Sushi. Incentivizing 300 $k worth of Badger liquidity on Swapr also doesn’t sound prudent given that there isn’t much to do there now with Badger tech. If new opportunities arise in the ecosystem, we’d be ready to deploy the strategies, but for now, it’s more of a liability to the DAO. Plus, the gas fees haven’t been that ridiculous lately, so potentially a part of our userbase can migrate back to Ethereum and participate in the Balancer + AURA play.

Implementation.

The BIP outlines the general budgeting and seeks approval for redirecting emissions from the vaults mentioned. It offers a general direction of change but also relies on Badger Council to ratify the specifics and whatever details need to be changed closer to the launch dates.

Due to the time constraints of the current schedule ending on June 30, the 48-hour snapshot will be posted no later than on Monday, June 27.

The BIP is subject to change based on feedback on the forum and the #rff-emissions-q3-2022 channel on the Badger Discord.

- Yes

- No