Overview

The BadgerDAO team and community have always been interested in exploring the overlap of NFTs and DeFi. There have been numerous events and drops that have resulted in the community accumulating NFTs but up until now they havent been of much use. In this proposal i have laid out a model for including NFT holdings in Badger Boost with a couple parameters that will be, if enabled, under the control of BADGER holders going forward.

Extensive discussion around the model was had here: Discord

Details

Each address will get a multiplier applied to their Badger Balance based on the NFTs held. Badger Balance is the numerator in the stake ratio that drives the each address’s badger boost.

Current StakeRatio = [Native Balance] / [Non-Native Balance]

New StakeRatio = ([Native Balance] * (1 + [NFT Multiplier])) / [Non-Native Balance] *

*Not including Max Mative Boost limit

Example

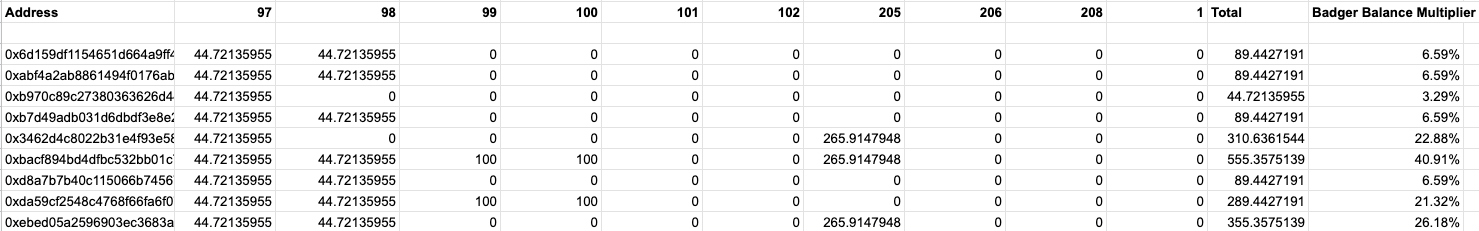

You can see an in-practice example of the proposed scoring method for the Badger NFTs in the sheet below.

https://docs.google.com/spreadsheets/d/1tLRI7Bk7d4d1mCYGxoI6uIFvj1eA8-9jhCXvgXxWiDA/edit?usp=sharing

Specific NFT weights are based off of whether or not Badger receives a portion of the transaction fees for the NFT and its rarity.

This formula was created to get what felt like appropriate scoring to start. The Partner/Collab/Badger inputs can always be tweaked.

All addresses are then given a total score which drives the multiplier

[NFT Multiplier] = ([Address Score] / [Total Possible Score]) * [Max Multiplier]

Max Native Boost

The major concern around the addition of the NFTs as a multiplier was around larger holders effectively diluting the BADGER supply by using NFTs to lever up. To address this concern I am also proposing a “Max Native Boost” parameter that will put a cap on how much any one address can add to their total Native balance by holding NFTs.

This will make the below the final formula for stakeratio:

([Native Balance] + min([Max Native Boost], [Native Balance] * [NFT Multiplier])) / [Non-Native Balance]

Looking Forward

This is just the initial model to get NFTs included. There is a more ambitious structure being worked on that will scale better with more NFTs and create a more gamified experience for users. This also leaves a lot of flexibility to do things like NFT of the week or month that gets some extra weight if the community wants to. Please reach out with any and all ideas on how to enhance the model.

Please also review BIP 63 and take into account its effects when placing your vote.

Governance

The inclusion question will be a normal snapshot vote. For max boost we will be using the results of the BIP vote to drive a ranked choice vote. The for the multiplier and max vote I will be trying a new method for vote-determined parameters.

- The widest range between any selections that gets >25% of the vote (or the top 3 if nothing breaches 25) in the BIP will be included in a snapshot ranked choice vote with 5-10 evenly distributed options.

- Ex → 50% and 150% multiplier both get 26% then options between 50-150 make it into the ranked choice snapshot.

- If the bottom or top range is gets more than 30% of the vote I will extend the options beyond.

- Anything getting a simple majority vote will be included as a parameter in the inclusion yes/no snapshot and will not have its own vote

- Yes

- No

- 25%

- 50%

- 100%

- 150%

- 200%

- 300%

- $100,000

- $200,000

- $500,000

- $1,000,000

- $2,000,000

- $5,000,000