Summary

This treasury decision is for Q1 2024, to fund Association operations with $1.6M USD equivalent (~16% year over year decrease relative to actuals with a ~$6M annualized forecast), while maintaining front of market security and development

Presentation - Badget 2024 - Q1 - TCD#42

(Badget 2024 - Q1 - TCD#42 - Google Slides).

The goal is to successfully launch and bring eBTC to market by the end of Q1.

The Association will provide a quarterly ‘State of the Association’ report that provides context into technical progress, product development, and overall operational performance.

Overview of request to fund the Badger Association for Q1 2024:

This corresponds to the first three months of the Badget, is in line with the spending plans, and 12 month’s trailing actuals. The caveat is that many one-time expenses may come due throughout the rest of the year, for instance legal fees or security audits for new development modules. These requests will be shared with the Treasury Council and included with subsequent quarterly budget proposals.

50% of contractor spend is USD equivalent and denominated in $BADGER at the current price. Should the price of $BADGER decline, we may need to request another round of funding from the Treasury Council to meet these obligations, as they are repriced once a month for the sake of the contractors. No single line of the Badget represents more than 10% of the overall ask.

Product and Commercial Milestone - Launch eBTC

- Finalize launch plan to manage risk and protocol execution (in collaboration with Block Analitica and Steakhouse through the BALCO) after public community feedback

- Design and execute seeding plan in collaboration with Treasury Council to bring eBTC to market and ensure a stabilized launch

- Execute the marketing launch plan and establish baselines to grow engagement (PR and influencer engagement, establish a pre/post launch baseline on content performance)

- Design and launch new incentive program with eBTC going live and a new partner

- Finalize and support 2 new eBTC protocol integration partners to go live shortly after launch

- Establish and start new BADGER token push in Asia with service providers across influencer, content, contests and social media marketing in conjunction with eBTC launch.

Technical development milestone - Launch eBTC

Web3

- Launch new testnet for release-0.6

- Complete continued external review of release-0.6

- Launch initial Eth-variant Zaps (enter/increase/exit collateral positions in native ETH, WETH, stETH, wstETH)

- Go live with pre-launch bug bounty (last official audit)

- Launch Guardrail monitoring services

- Execute multiple incident response drills pre launch in accordance with the IR plan

- Merge final audit recommendations

- Launch eBTC protocol on mainnet

- Go live with official post launch bug bounty (Immunefi)

Web2:

- Release eBTC SDK

- Support new testnet deployment in eBTC.finance dapp

- Build, launch, and run all bots (liquidation, MEV, etc)

- Integrate dedicated incentive program into eBTC.finance dapp

- Support ETH variant zaps in eBTC.finance dapp on mainnet

- Deploy Reward distribution engine in eBTC.finance dapp

- Launch eBTC.finance dapp with mainnet contracts deployed

- Launch & support eBTC tracking dashboard in collaboration with Block Analitica. (examples: Maker, Aave, Compound, Spark)

Operational milestone - Execute transparency plan

As outlined in the understanding the Association post, the Badger Treasury is independent of the Association. This presents an opportunity to improve communication with dedicated Association insights provided through reporting.

A new quarterly ‘State of the Association’ report will provide context into progress, such as:

- Technical development progress against roadmap

- Product, operations and growth updates

- Financial performance (i.e. budget vs actuals commentary)

The Association will improve communication and transparency under the following guidelines:

Road to eBTC

2023 powered innovation in the product direction and technical build with eBTC. The modular approach has enhanced a growth vision and product roadmap that accelerates bringing BTC to DeFi. Badger is uniquely positioned to execute and bring global adoption to the leading smart contract based BTC in the industry.

Driving supply and demand are the core components of scaling a stablecoin in our space while ensuring these drivers enable stability in the synthetic asset.

The first core supply driver is leverage seekers looking to trade the ETH/BTC ratio in the most capital efficient way possible. This is doable through the eBTC CDP system. Although not exceptionally strong, the first demand driver will be to hold and LP a more decentralized BTC on Ethereum users can trust and verify.

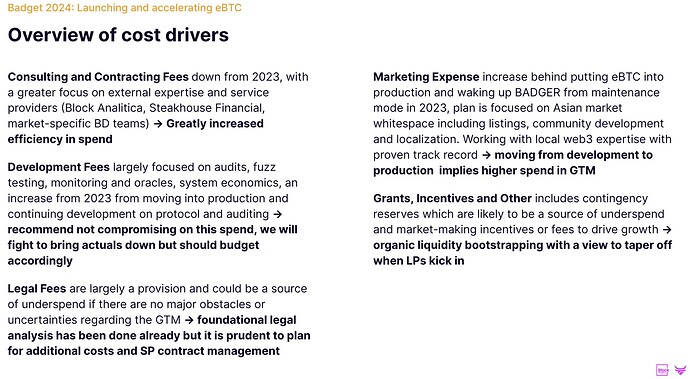

eBTC is in late stage development and the Q1 milestone goals are focused on bringing it to market. Here’s a summary of the pull through cost drivers to support reaching these milestones:

Capital Alignment

Treasury and product are not isolated. They uniquely blend with tech, economics, and marketing. This informs an opportunity to progress first principles strategy from the treasury management policy to enable allocations focused on surplus resilience and solvency of eBTC. Be relentless in feeding the machine towards profitability and scale.

State of DAO reports have delivered solid insight into the market and will continue to be powered by real time public financials. Transparency with treasury decisions, with a security focused approach always being the anchor, will continue.

Further, support will progress more with Block Analitica powered eBTC dashboards. This will help integrate capital and downstream product performance, in collaboration with Steakhouse Financial and eBTC developers. During implementation of the 2024 - Q1 budget, the financial operations repo and supporting payments infrastructure will be upgraded to power these public dashboards with a sustainable approach to support the DAO and separate Association reporting:

Treasury Portfolio - BadgerDAO

Capital deployment in alignment with financial operations and development milestones will force smart offense in the high velocity crypto and stablecoin market, while being mindful it’s a dynamic technology and commercialization process.

Principled peg management guidelines ahead of eBTC launch will put the Treasury Council in a strong position to react fast to market changes and maintain parameters close to equilibrium so that the peg is maintained within 1%.

At the same time Badger learned that R&D to fuel growth is highly specialized and costly, so the Association’s 2024 - Q1 operating budget will protect that level of quality and security investment.

Expanding perspectives with expert service providers is a key growth driver in supporting BADGER, eBTC, and the greater Badger ecosystem. The Association has fostered relationships with leading players across multiple disciplines in supporting the ecosystem.

Risk Management

Proactive protocol health management and daily operations is mission critical. User safety and system performance will be supported with dedicated risk assessment, monitoring, and mitigation publicly, in collaboration with industry leading service providers such as Block Analitica. This drives scale ready growth into the balance sheet to maximize healthy liability growth and issuance towards profitability.

Active improvements on performance will create excess capital to increase liquidity and incentivize adoption to drive higher trading volume. The management of key risk indicators impact:

- Capital adequacy to support frameworks powered by best in class benchmarks

- Liquidity adequacy to keep ample liquidity through protocol owned liquidity (POL) and WBTC on smart contracts to guarantee redemption

- Sustainable operations, maintained with 1+ year of runway

- Resilience by minimizing trust assumptions with an on chain focus

In preparation for eBTC launch, work is underway to power a public dashboard to track eBTC performance, supported by ongoing risk management and parameter recommendations from Block Analytica, Steakhouse Financial, and relevant Contributors.

Growth Enablement

With eBTC coming to market, shifting to building eBTC CDP adoption will fuel pipeline for bigger integrations and partnerships creating the leading decentralized BTC in the industry.

$BADGER token is uniquely positioned to complement eBTC awareness and expansion with its BTC focused mission, strong listing distribution, and volume. There is opportunity to play offense in high velocity markets and grow with Asia expansion, with Korea as market entry. To accelerate speed and depth for expansion, Badger is working with industry leading localized service providers.

The Badger ecosystem and eBTC go to market is focused on security, delivery expertise, and minimized governance to reduce risk and improve decentralization.

The 2024 - Q1 Association Badget builds from Badger’s experience and fuels a new chapter of growth.