Per BIP 74:

The long-term goal with managing the liquidity is to have at least (-50%; 0%) price range covered at all times.

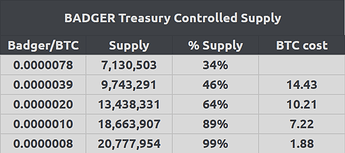

The current state of BADGER TCL is that roughly a 50% price drop is covered, so it’s time to deploy the next range with the following parameters:

-

Lower bound price: 195 sats

-

Higher bound price: 390 sats

-

BTC to deposit: 10.21

Currently, Badger Treasury has accumulated about 1/3 of the total token supply, primarily through TCL buybacks. If the next two ranges are filled, that is projected to become 64%:

Another part of this proposal is to deploy the final TCL range:

-

Lower bound price: 97 sats

-

Higher bound price: 195 sats

-

BTC to deposit: 7.22

If this range gets filled, that would imply that Badger Treasury has bought 89% of total supply off the market, so it’s not a likely scenario.

Still, I find it convenient to deploy this range as a way to earmark TCL funds onchain - and thus have a clearer distinction between runway and TCL allocations.

Vote

- Yes, deploy the next two ranges as specified above

- No, only deploy the next range as required by the BIP