TCD#73: Top Up Of Treasury CDP collateral

TLDR: This is a stand-alone top up of the Treasury CDP to 200% CR. These funds will remain in place until December 1st 2024 when they will be re-evaluated based on the policy outlined in TCD 67.

Background

The Treasury Council enacted a policy in TCD 67 to top up its position in the eBTC CDP in order to maintain a ratio above 175%, if the value falls 20% below that. However, the recent market trend and increased volatility of both assets against the dollar (USD) warrants a one time top up to allow for a temporary larger downside volatility protection in the position.

Proposal

- Top-up CDP with more collateral (stETH) to 200% CR

- Allow the funds to remain in the position until December 1, 2024 when they will be re-evaluated by the Treasury council following the guidelines of TCD 67

Metrics of Success

How long will the investment thesis take to play out?

Until December 1, 2024 where a re-evaluation will be performed by the Treasury Council

Will the treasury recoup funds or does the investment represent an outlay?

The Treasury is expected to recover these funds but this is dependent on market conditions.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

2 - This is a deposit in the eBTC protocol which was created by Badger and thoroughly audited.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

0 - This is a deposit into a CDP and doesn’t require market liquidity.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

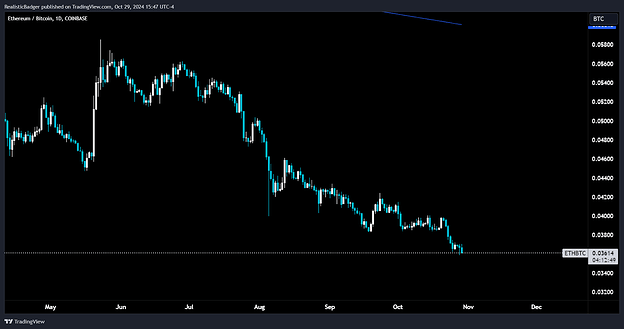

4 - The ETH/BTC ratio will impact the total CR of the Treasury’s position. This is an action to reduce that market risk by increasing the CR. However, the momentum in the ratio has been trending to the downside in recent months.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

0 - There is little to no counterparty risk in this decision; the counterparty risk is instead transferred to the protocol risk.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

1 - This decision will require execution on the Treasury multi-sig. However, this is a familiar task.

Parameters For Program End

- On December 1, 2024 this deposit will be re-evaluated based on TCD 67 and the funds may become available for other uses.