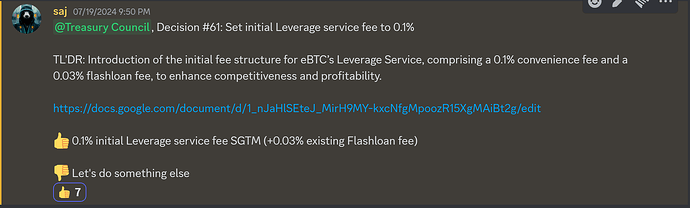

TLDR: Introduction of the initial fee structure for eBTC’s Leverage Service, comprising a 0.1% convenience fee and a 0.03% flashloan fee, to enhance competitiveness and profitability.

Background

To enhance the leverage trading offering for eBTC, a thorough analysis of competitor fees and potential revenue models was conducted. Competitor platforms charge various fees, as follows:

Decentralized Platforms:

- DefiSaver: 0.25% on swapped amount

- Summerfi: 0.2% on swapped amount

- GMX: 0.1% opening fee + variable swap fees

- Helix: 0.02% - 0.1%

- ApeX: 0.05%

- PancakeSwap: 0.25%

Centralized Platforms:

- Binance: 0.1% trading fee + interest on borrowed amount

- Bybit: 0.075% trading fee + interest on borrowed amount

- BitMEX: 0.075% trading fee + interest on borrowed amount

Our current system charges a 0.03% fee on flashloan amounts. After evaluating different fee structures, it is proposed to maintain the 0.03% flashloan fee and introduce a 0.1% convenience fee on the debt amount minted.

Proposal

The proposed fee structure is:

- Flashloan Fee: 0.03%

- Convenience Fee: 0.1% on the debt amount minted

This structure is competitive compared to other decentralized platforms and aims to strike a balance between attracting users and generating revenue. The detailed analysis revealed that this fee structure could significantly enhance user experience while being profitable as liquidity grows.

Metrics of Success

How long will the investment thesis take to play out?

The investment thesis is expected to play out within 6 to 12 months, considering the initial traction and user adoption.

Will the treasury recoup funds or does the investment represent an outlay?

The treasury is expected to recoup funds through the generated fees, making this investment self-sustaining over time.

Revenue projections based on different monthly trading volumes are as follows:

| Monthly Volume ($) | Revenue |

|---|---|

| 10,000,000 | $13,000 |

| 50,000,000 | $65,000 |

| 100,000,000 | $130,000 |

| 500,000,000 | $650,000 |

| 1,000,000,000 | $1,300,000 |

These estimates are based on the 0.03% flashloan fee and the 0.1% convenience fee on the debt amount minted.

What are the risks associated with each investment?

- Protocol risk (0 - 10): Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

2: Likelihood of a smart contract issue impacting the new fee structure is low. The fee adjustment is a straightforward implementation within the existing smart contract framework, with minimal risk of introducing vulnerabilities. The C4 contest included the fee mechanism within its scope and found no vulnerabilities.

- Liquidity risk (0 - 10): Liquidity risk refers to how easily an asset can be bought or sold in the market.

1: The introduction of the new fee structure is unlikely to impact liquidity directly. The fee rates are competitive, and the anticipated volume growth should mitigate any potential liquidity concerns.

- Market risk (0 - 10): Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

1: Market conditions could affect the volume of leveraged trades, thereby impacting fee revenue. However, the fee structure itself is designed to be competitive in varying market conditions.

- Credit risk (0 - 10): The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected.

0: Fees are secured at the SC level.

- Execution risk (0-10): How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

2: Implementation of the new fee structure is straightforward and can be executed with minimal delay. The primary risk is ensuring that users are informed of the new fees to prevent any confusion or dissatisfaction.