TCD #58 - Q3 2024 Association Budget

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by The Badger Association and The Badger Treasury Council.

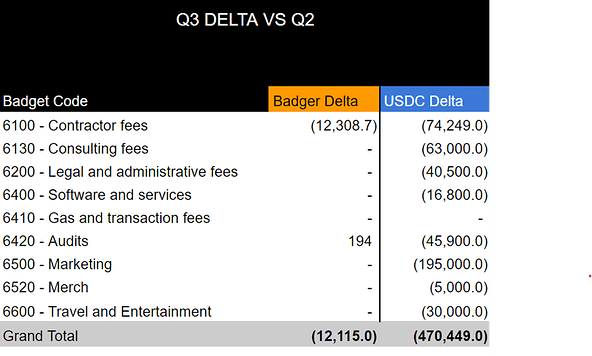

TLDR; For Q3 2024 the Association operating budget is requested to be ~500kUSDC (~500K reduction from Q2) and ~30k BADGER. The goal is to build on the momentum from the eBTC launch, create eBTC foundational growth and refocus on strategic planning to build future value through Treasury and Association collaboration.

Background

Overview of request to fund the Badger Association for Q3 2024:

50% of contractor spend has been redenominated in $BADGER at the current price. Should the price of $BADGER decline, we may need to request another round of funding from the Treasury Council to meet these obligations, as they are repriced once a month for the sake of the contractors. No single line of the Badget represents more than 10% of the overall request.

Accounting for Q2 variances, the actual request in tokens is as follows:

Contractor Fees

100% of the Contractor Fees category is related to product development, software engineering, smart contract development, security and risk management, and the operations. Reduced due to less contractors this quarter.

Consulting Fees

BALCO, systems, and security costs. Main reduction areas are due to less auditing requirements.

Marketing Fees

Marketing fees have been dramatically reduced due to the priority for Strategic Planning from the Treasury and Association. Strategy will drive the go-to-market strategy.

Audit Expenses

Slightly lower this quarter in anticipation of development timelines. These are contractors such as Guardrail, Hypernative, Spearbit and so forth (security, web2 and web3 monitoring, and alerts).

Legal and Administrative Fees

Legal and travel are reduced. Legal expenses are optimized in anticipation of any potential requests or clarifications but may not be used entirely.

Product and Commercial Milestone

The following product initiatives were presented to the Treasury for approval and prioritization and the work will be signed off and determined for delivery based on continued collaboration between the Treasury and Association. Please note that not all of these initiatives will be developed in Q3 and are just recommendations waiting for approval.

- stBTC V1

- Bitcoin Stability Module (BSM)

- Extensible Minting with Spark.fi Integration

- Lending Protocols Integrations

- Enterprise Integrations

- Cross-chain Strategy Integrations

Technical development milestone

Web3

- Support eBTC protocol with monitoring, alerting, and incident response partners

- Provide technical advisory and execution for BALCO recommendations

- Fee Redistribution Module: Automation for Fee Recipient multisig that claims fees, splits them and distributes them to different destinations.

Web2:

- Improvements to the eBTC App: Add banners with integrations and use cases.

- Sunset app: Add legacy vaults and tree claiming to sunset app → deprecation of less cost efficient legacy app.

- eBTC Safe App: Enable eBTC for use directly from the safe app.

- In House Merkl Rewards Distribution: Introduce the ability to distribute rewards via a Tree-like system.

Operational milestone - Execute transparency plan

The Association will continue to share Association insights provided through updates and reporting:

- Technical development progress against roadmap

- Product, operations and growth updates

- Financial performance (i.e. budget vs actuals commentary)

Implementation

- The Treasury will send 76,454 BADGER to the Association payments multi-sig

- The Treasury will send 332,207 USDC to the Association payments multi-sig

Note - these numbers account for the Q2 variance (see above)

Metrics of Success

How long will the investment thesis take to play out?

This funding is for work to be done in Q3 by the Association. It is understood that some projects will require more than Q3 to be completed.

Will the treasury recoup funds or does the investment represent an outlay?

This investment is expected to bring a positive return on a longer time horizon as it will be essential in the growth of eBTC.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

0 - These funds are being used to pay contractors. There is no protocol risk.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

0 - Not Applicable.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

4 - Some of the funds are denominated in Badger repriced monthly to USD. This creates variance if the Badger price changes.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

0 - There is no credit risk present in this decision

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

1 - This decision will require funds to be transferred between multi-sigs.