We are all bleeding together. However, there will come a point when the MC of DIGG and the Supply even out, and we will be at equilibrium. However, each time DIGG rises above peg, it is not unfounded that people will try to get their investment out as soon as possible. So, I suggest we take a page out of Tomb.Finance’s algo coin book and introduce a Gatekeeper system while the token is in its infancy.

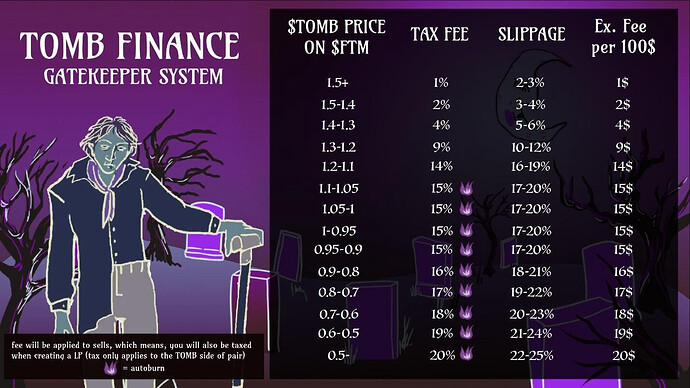

Essentially, the Gatekeeper would create a tax (used as slippage on uni/sushi/pancake) for any sales of DIGG and bDIGG when close to or under peg. That tax is burned (we can do other things, like return to treasury for KPI options) with the intent of stopping heavy whale sell pressure when at or below peg. Another issue is it is a profitable venture to swing trade the token when it is below peg. A move from 0.64-0.84 presents a 20% gain, but no opportunity for the token to spring back to life. Therefore, here is the tax chart I suggest (lifted from TOMB, docs below):

Please let me know what you think. Something dramatic has to change to stop the bleeding, and I think we should leave no stone unturned in this recovery.

For further reading on Gatekeeper systems: