Category: Vault strategies and emissions

Scope: bveCVX and bveCVX/CVX LP rewards management

TL;DR:

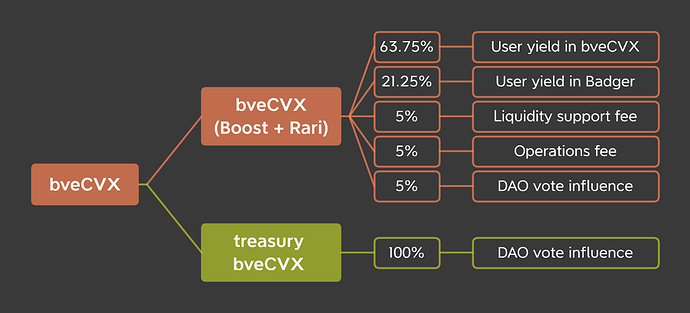

- Change bveCVX voting strategy to selling bribes by default, with an option to strategically replace bribe selling with emissions if deemed reasonable by the Council.

- Take the following fees in vote weight:

- 5% to support DAO operations

- 5% to support bveCVX/CVX LP emissions

- 5% to support BADGER/WBTC CVX & CRV yield

- Rewards from the bribe selling would be distributed in 75% bveCVX / 25% Badger.

- bveCVX would keep participating in the Boost as native balance per BIP 85 and also would become available as collateral on Rari while keeping the rewards and the Boost power.

- Stop distributing Badger and cvxCRV from the emissions schedule to bveCVX unless it’s deemed cost-efficient to buy the vote weight from it.

Overview

The current state of the Convex bribe market is that every $1 spent on bribes is distributing about 1.26$ to the entire pool that bribed vlCVX votes.

This means that to get breakeven on your bribe, you need to own at least 79% of the pool that you’re voting for.

As Badger currently takes 20% performance fees on most Ethereum vaults and Badger emissions to bveCVX are akin to bribing, even at 100% Curve pool capture the DAO would still be losing 75 cents on a dollar spent on bveCVX’s vote weight.

This means that the Badger flywheel isn’t possible in the current market conditions, and spending Badger and cvxCRV emissions on bveCVX is cost-inefficient for the DAO.

At the same time, if we were to make the voting cost-efficient, a lot of CVX would likely leave the app.

BveCVX holders have signaled that they’re interested in having yields comparable to Votium, and this proposal is meant to implement a more sustainable bveCVX model that:

- Keeps the bveCVX APR competitive

- Doesn’t require the treasury to spend Badger or cvxCRV

- Is supportive of Badger ecosystem

- Emits a mix of more bveCVX and BADGER bought from bribes.

Specifics.

By default, bveCVX would be:

- Selling 85% of its voting power for bribes to buy 75/25 bveCVX and Badger and distribute it to bveCVX holders

- Selling 5% of its voting power for bribes to buy Badger and distribute it to bveCVX/CVX LPs

- Selling 5% of its voting power for bribes to buy treasury bveCVX (the operations fee).

- Voting with 5% of its vote weight for Badger/WBTC LP on Curve.

bveCVX and bveCVX LP would keep being counted as native in the Boost, and could be utilized as collateral on Rari while keeping the rewards and the Boost power. bveCVX LP holders would keep getting the underlying bveCVX rewards from the bveCVX in LP.

The proposal also suggests isolating the treasury’s bveCVX and focusing its voting power on Badger/WBTC Curve V2 pool rewards. Note that as specified below, this default behavior may be changed by the Badger Council.

bcvxCRV and Badger emissions from the treasury towards bveCVX would stop, but there would be an option to buy up to 21.25% of bveCVX voting power by replacing the bribes with Badger emissions if deemed cost-efficient.

The decisions about changing the DAO’s voting with its own weight or replacing a portion of rewards with Badger or other token emissions would have to be:

- Discussed for at least 48 hours in #bveCVX-voting channel on Discord

- Ratified by a Badger Council vote.

- The Badger Council may appoint a subcouncil to handle this decision-making.

Implementation.

If approved by the governance, this BIP would change the way the voting weight is handled for bveCVX.

Extraordinary bcvxCRV and Badger paid from the treasury to bveCVX would stop and be replaced with bveCVX and Badger tokens acquired through bribe selling.

Emissions could be used strategically if deemed reasonable by the Council, replacing the bribe yield.

- Yes

- No

0 voters