Category:

Treasury Management

Scope: Deposit Treasury BTC’s from the Dev Multisig into our own setts and blacklist the deposits for Badger emissions so user APY is undiluted.

Status:

Pending (Following up on a post by @gosuto a week and a half ago and recent work by @Tritium)

Objective:

Generate further returns for Treasury Bitcoin by depositing into Badger Setts, begin to build a framework for agile deployment of DAO Treasury assets.

Overview:

Dogfooding is the idea of using your own products whenever possible, it can not only provide insight into user experience but can also solidify market trust in the product or products.

This proposal would take assets from the Dev Multisig and deposit them into Badger Sett products, the code having now been battle tested for 7 months.

At current prices just depositing in our own Setts (blacklisting native yield for those assets) could very conservatively net the DAO $1000 of extra income per day. We run these products, we should use them.

If the votes below all pass, the core team will have discretionary power over reallocation to any of Badger’s Sett products, as well as the power to deploy further assets from revenue as they are accrued.

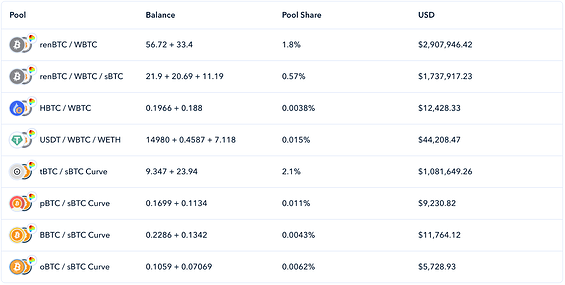

Below is a list of target Setts with allocations we believe provide the best risk profile:

Further, the team will explore using the harvester to auto-invest in our own Setts. This could be the beginning of a number of treasury and utility focused Setts built upon our forthcoming V2 infrastructure.

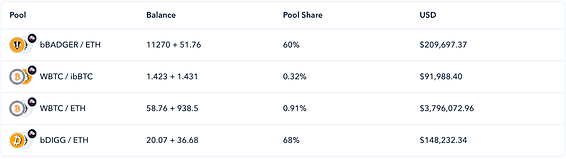

Below are the funds (minus native balances and liquidity positions) that are eligible under this BIP.

Considerations have been made to simplicity of operations, the proposed plan gives the team the mandate to get funds working ASAP and is low opportunity cost. More complex procedures and dynamic management can and will eventually be built on top to maximize DAO performance.

Additionally the CVX the DAO will acquire from these strategies will not only hold value, but provide voting weight Sett product returns.

Moving Forward:

The first vote allows the team to deposit currently held revenue assets to any of our Sett products.

Do you approve of dogfooding our Setts with currently held revenue assets?

- Yes

- No

The second vote gives the team the right to periodically deposit new revenues to our Setts and further explore and implement an automation for the process

Do you approve team discretionary power over dogfooding with future collected fees?

- Yes

- No

The third vote gives team discretion over like-kind exchanges of assets to maximize performance.

Do you approve of the core team moving treasury assets between curve Setts to optimize yields?

- Yes

- No