Category: Treasury / Goverance

Scope: Deploy Rari Fuse Pool | Approve collateral assets for Gov + Boost | Seed pool w/ treasury funds

Status: Pending

Overview

I am proposing to deploy a Fuse lending pool on Rari. Fuse pools are independent forks of compound, in this scenario badgerDAO would retain admin rights to manage pool assets and parameters. Rari receives an admin fee (10%) of the interest earned on all loans.

More Here: https://docs.rari.capital/fuse/

This pool will give badger native asset holders another location to put their assets to work. If the pool is successful in having abundant use over the initial couple months, I will be advocating for Rari to share a portion of the admin fee with badger going forward.

It will be the job of BADGER holders to manage this pool going forward, irresponsible asset or parameter selection can add systemic risk to the pool so careful consideration is needed for any decisions.

Details

There are 3 decisions as part of this BIP

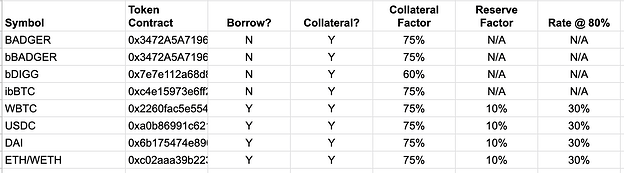

Deploy the Pool with below parameters

https://docs.google.com/spreadsheets/d/1dXd_DUpa6zbbCwK1_Aaqpw1dhKwGzh3Qgx0_eAtF7QM/edit?usp=sharing

The native Badger assets will not be enabled for borrowing so that they can retain their base uses in governance and the boost. We can also discuss adding other vault tokens

Include Native asset deposits in Governance + Boost

I am proposing to include deposited BADGER (fBADGER), bBADGER (fbBADGER), and bDIGG (fbDIGG) at equivalent dollar value in Governance and Native balance for Boost. Since they will not be enabled for borrowing there is not a concern around tokens being double counted. bDIGG collateral deposits will also be included in the DIGG rebase options calculations.

This will enable badger users to do things like leverage up their boost (borrow USDC against BADGER/DIGG buy more BADGER/DIGG), earn non-native yield as BADGER only holder (borrow WBTC against BADGER, deposit into BADGER to earn high yield on WBTC)

Seed the Pool with assets from the treasury

When the pool launches there will not be any funds to borrow. With the expectation being that Badger holders will want to use the platform to borrow stables to farm with or lever up on positions it will be critical to the success of the rollout to have assets available for depositors. The proposal is for $1million in USDC to be added on launch with another $1million to be added if the pool reaches >50% utilization.

- USDC - $1million (with option to add $1m more

- WBTC - 30 WBTC

Please discuss asset mixes and sizes in the responses, a new poll can be added with different seed parameters if popular.

Governance

- Yes

- No

- Both

- Governance Only

- Boost Only

- Neither

- Yes

- No