Category: Emissions

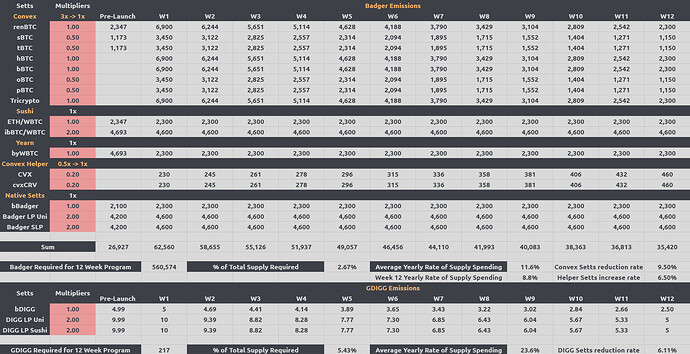

Scope: Badger and DIGG Sett Emissions for the period before Convex Setts Launch and for 12 Weeks After.

Status: Accepted: Snapshot

The emissions schedule is available in this sheet

TL;DR:

- Stay on the 22nd-week schedule before Convex Launch

- Gradual emission reduction schedule for DIGG

- Keep the same level of rewards as the 22nd week for:

- Badger Native Setts: bBadger, Badger LPs on Uniswap and Sushiswap

- Sushi Setts: ETH/WBTC SLP, ibBTC/WBTC SLP

- Boost the Rewards for Convex Setts for the 12 Week Liquidity Mining Program, gradually reducing them from 3x to 1x throughout the Program as a substitute to the Launch Boost.

- Halve the rewards for byWBTC Sett and keep them on this level for the duration of the Program

- Introduce the Rewards for BadgerDAO Convex Helper Vaults (CVX and cvxCRV)

Overview:

BadgerDAO is preparing to migrate our Curve Setts to Convex and launch five new vaults there.

At the same time, the 22 Week Liquidity Mining Program is about to end.

Convex Launch is a big opportunity for BadgerDAO to increase its market share and further advance itself as a go-to place to park your Bitcoin in DeFi.

Convex rewards scale.

This means that if we bring in a lot of liquidity there, the underlying APY of our Setts will grow with time, as more voting weight will go towards the underlying liquidity pools.

In the future, CVX will be used for voting on gauge weights on Curve.

With the strategy of accumulating interest-bearing Convex tokens in the DAO treasury and distributing them to our users, we will increase the DAO voting power in the Convex governance, which will bring more yield to our core Setts in the future.

Before Convex Launch I suggest keeping the same schedule as this week, the last week of the 22 Week Liquidity Mining Program.

With the Convex Setts Launch, I propose to initiate the following schedule:

Specifics:

The transition period between the two liquidity mining programs.

This Thursday, the 22 Week Liquidity Mining Program comes to an end, and Convex Setts will be launched when everything is ready and good to go with at least a 24-hour notice.

Between this Thursday and the Launch date, there will be a period when the old Liquidity Mining Program comes to an end, and the new one hasn’t yet started.

I propose to keep the rewards at the same rate as this week, which would effectively be the vote for no change in this case.

Due to the time constraints of this governance decision and the fact that it’s relatively small, a snapshot to prolong the emissions for the transition period will be posted simultaneously with this BIP going live.

- Yes

- No

This is another attempt at exploring flexible decision making by the BadgerDAO governance.

An alternative to that would be for the decision to be voted on by the Badger Council - or made by the core team. Please share your feedback on what option you prefer in this situation and why:

- Do an immediate token holders snapshot vote

- Badger Council voting on the decision

- the core team making the decision

- Other (specify in the comments)

DIGG Emissions

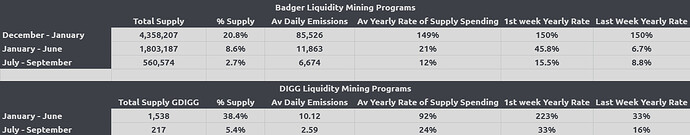

The main goal behind gradual emission reduction, introduced with the 22 Week Liquidity Mining program, is to arrive at sustainable emission rates.

I believe a good metric to assess that sustainability is the Yearly Rate of Supply Spending.

As an example, on the first week of BadgerDAO existence, it emitted 603,750 Badger, which translates into 31.5 Million Badger Yearly Emissions, or roughly 150% of the total Badger supply.

Here’s how this number looks historically and for the proposed 12 Week Liquidity Mining Program:

Evidently, DIGG still hasn’t arrived at a sustainable rate of emissions: the entire DIGG treasury would be spent in a year at the current rate. Thus I believe a further emission reduction and the development of more effective supply spending solutions are needed for it, like the revamped DIGG options.

- Yes

- No

Badger is in a better position regarding this metric, and this allows us to boost the rewards to our Setts, bring more liquidity to Convex and Curve, and capitalize on the opportunity to Boost the long term underlying rewards to our core product.

Convex Setts rewards schedule and Boost.

Convex rewards scale.

More Bitcoin liquidity on Convex means that it will be generating more CRV for the platform, and thus a higher relative gauge weight will be assigned to Bitcoin liquidity pools by Convex in the following Curve gauge weight vote.

This, in turn, will feed into more CRV earned by the platform and a higher relative weight in the next vote.

On top of that, CVX is rewarded to liquidity pools pro-rata to CRV generated by the platform.

So with time, provided the liquidity stays, CVX and CRV rewards to the pools should be increasing.

Another feature of Convex is that all harvests are being streamed to active participants in the pool over a 7 day period from the moment a harvest was called, which creates some delay in receiving the rewards when new liquidity joins the pool.

In order to accommodate for these features, I suggest a prolonged rate of elevated rewards to Convex pools with a gradual reduction rate as a substitute to the standard launch boost structure.

The proposal is to launch with 3x the rewards, and gradually reduce them towards 1x at a 9.50% weekly reduction rate.

When it comes to individual Sett rewards, I suggest:

- keeping the same base rates for the old pools,

- adding large new vaults (hbtc, bbtc, tricrypto) at a 1x multiplier (similar to renBTC)

- adding smaller vaults (oBTC, pBTC) at a 0.5x multiplier.

- Yes

- No

Sushi and Native Sett rewards.

Emissions for Badger Native Setts and Sushi Setts are proposed to be on the same level as they are now.

- Yes

- No

byWBTC Sett rewards halving.

The community has expressed frustration that byWBTC Sett’s performance thus far hasn’t been justifying the fees. As part of the preparation for the Convex Launch, there is a proposal to change the Fee structure that’s going to affect byWBTC withdrawal fees too, decreasing them from 0.50% to 0.20%.

When it comes to Curve Setts migration, that fee change is more justified for the DAO. The increased underlying APY in conjunction with the increased performance fee will cover the treasury inflow loss that comes from decreasing the withdrawal fee.

With byWBTC vault, there are not going to be these compensatory changes, at least immediately, and thus the vault cost-efficiency is going to drop.

While byWBTC Sett remains the core component of ibBTC and of the DAO vault product, we’re about to launch 7 BTC vaults on Convex, so it makes sense to spread the incentives around.

Thus the suggestion is to halve the rewards for byWBTC Sett and keep them on the same level (1x base multiplier) for the duration of the 12 Week liquidity mining event.

This would make the rewards similar to Sushi WBTC/ETH Sett.

- Yes

- No

Helper Vaults.

With Convex Launch, BadgerDAO will introduce two Helper vaults for CVX and cvxCRV.

Sett users will receive interest-bearing versions of CVX and cvxCRV that autocompound the rewards.

In order to add stickiness to these rewards within the app and provide a pathway to earn more Badger by keeping them, I suggest issuing a base rate of rewards to these tokens that gradually increases throughout the 12 Week Liquidity Mining Program.

The increasing rewards structure for Helper Vaults allows them to scale a bit better with the CVX and cvxCRV rewards that Badger Sett users collect.

- Yes

- No

Implementation:

As mentioned earlier, due to the time constraints around keeping the emissions going, the snapshot about the transitional period will be posted simultaneously with the BIP.

There will be considerably more time to discuss and vote on the other parts of the BIP.

If the governance approves the changes to the emission schedule, they will become active with the Launch of Convex Setts in the Badger app.