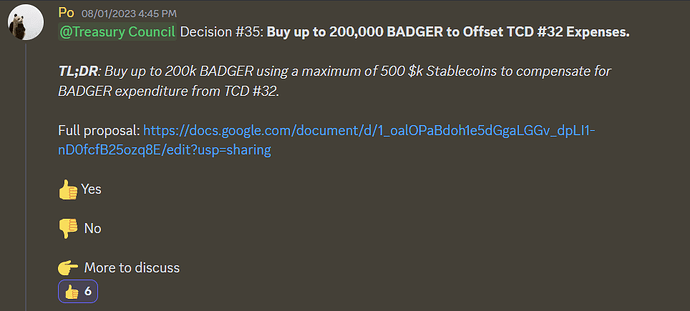

TCD #35: Buy up to 200,000 BADGER to Offset TCD #32 Expenses.

Note: TCD#32 has not been made public as per BIP 89 TCD #32 will be made public 24 hours after execution.

TL;DR:

Buy up to 200k BADGER using a maximum of 500 $k Stablecoins to compensate for BADGER expenditure from TCD #32.

Background.

The 200k BADGER expenditure from TCD #32, while enhancing the token’s liquidity environment on CEXs, also implies a conditional selling loss if BADGER trades noticeably above +25% six months after the Commencement Date.

By conditional selling loss, I mean that whenever the option to repay the loan in USDT is exercised, it signifies that the tokens’ open market value is higher - and the difference between the two constitutes the loss.

Recommendation.

To hedge this exposure, I propose to buy up to 200,000 BADGER with a maximum of $500,000 in Stablecoins.

This would mean that in the scenario where the option to repay the loan in USDT is exercised:

the DAO maintains full exposure to the committed BADGER’s upside

the DAO still earns the difference between the price at which the DAO purchases BADGER and the Commencement Date price +25%.

If the option is not exercised, the investment would show a negative ROI only in the situation where the DAO has to spend the BADGER acquired at prices lower than the buying price.

Metrics of Success.

How long will the investment thesis take to play out?

In the optimistic scenario, it would take 6 or 12 months for the TCD #32 option to get exercised, at which point the treasury would see about a 25% profit on its Stablecoin investment while retaining full BADGER exposure.

In the pessimistic scenario, indefinitely. The funds will be swapped to BADGER and are expected to remain in the Treasury until spent through Runway, Emissions, or Incentives.

The investment thesis in the pessimistic scenario is that by the time this BADGER will need to be spent, it will be at or above the purchase price.

Will the treasury recoup funds or does the investment represent an outlay?

The Treasury anticipates a positive return on this investment.

What are the risks associated with each investment?

Protocol risk (0 - 10)

0 - This is an investment in the Native token and therefore has no extra protocol risk outside of BadgerDAO.

Liquidity risk (0 - 10)

4 - Given BADGER’s on-chain liquidity, the slippage is expected to be less than 6%.

Market risk (0 - 10)

6 - BADGER is a volatile token.

However, the market risk is partially mitigated in this proposal by limiting the amount of Stablecoins to be spent.

Credit risk (0 - 10)

0 - There is little to no counterparty risk in this decision; the counterparty risk is instead transferred to the protocol risk.

Execution risk (0-10)

4 - This decision gives discretion of execution to the Treasury Multisig. This requires some management and extra attention from signers.

Parameters For Program End.

This TCD will be executed when either 200,000 BADGER is acquired or when $500,000 in stablecoins have been swapped to BADGER, whichever comes first.

Cowswap explorer for transactions can be found here:

Result: 45,596.765 + 47,285.7247 + 47,549.5357 + 64,151.1085 = 204583.1339 BADGER for 450K USDT