TLDR: Cease emissions for bcvxCRV for the rest of Q1.

Background

End of the year the treasury council proposed a continuation of the emissions for bcvxCRV during Q1 of 1552 Badger/week, with the plan for reassessing during February based on how the TVL changes and ratio between revenue and cost.

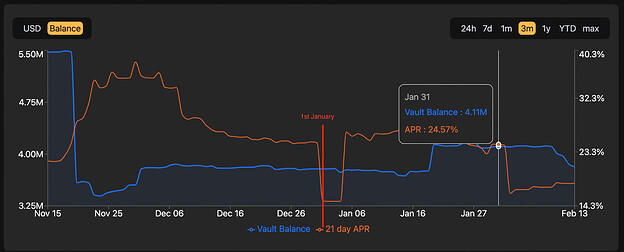

Figures show that the underlying balance of bcvxCRV during the month of January grew 8.73%, from 3.78M on 1st Jan to 4.11M on 1st February. ref

However, at the same time the revenue:cost ratio presents itself at $4.4k vs $20k. Spending 4x more than revenue when looking at bcvxCRV in isolation. Ref

Given that bcvxCRV emissions were not distributed flat, but instead based on native holdings, we consider revenue coming from native vaults being interconnected to the bcvxCRV product: 80/20 BADGER/WBTC Aura, 50/50 BADGER/WBTC Convex and graviAURA/DIGG/WBTC. Considering the % users which are holders of bcvxCRV and each native vault, figures are the following: reference on native vault revenue per product

- 80/20 BADGER/WBTC Aura revenue in Jan: $4365 * 48% = $2095

- 50/50 BADGER/WBTC Convex revenue in Jan: $2563 * 100% = $2563

- graviAURA/DIGG/WBTC revenue in Jan: $2875 * 74% = $2127

Summing up bcvxCRV performances fees, $4462, together with native vault revenue totalling $6785, still the DAO does not reach break-even point with the cost.

Proposal

Reduce emissions completely to zero in bcvxCRV given that breakeven has not been reached in revenue:cost ratio and the TVL growth over January was minor. Reevaluate emissions at the end of Q1.