Valuing An Investment - GTC Diversification Strategy

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger on GTC diversification strategy using UniV3.

TLDR; BadgerDAO has held a large number of GTC tokens for over a year. Due to the assets relative underperformance, the Treasury team has decided to begin diversifying out of GTC by using a UniV3 strategy to help capture potential upside in the token in 2023.

Background

GTC has drawn down -98% from its all time high. While the tokenomics around GTC are lacking, the fundamental project (Gitcoin) has been very successful within DeFi. It is likely that GTC/ETH has reached some temporary local bottom against ETH. In order to get the most out of BadgerDAO’s GTC position it would make the most sense to deposit GTC into UNIV3 ranges rather than selling it all at current market prices. This will allow up to ~30% more ETH to be received than selling GTC now if prices move up in 2023. This is effectively selling put options against the GTC, it allows for yields to be earned during the divestment period rather than paying swap fees to an exchange and losing money due to slippage. On top of that, it provides utility for GTC by increasing its on-chain liquidity depth while the position is active.

Because of UniV3’s customizability, below is technical evidence for splitting the GTC into two separate ranges.

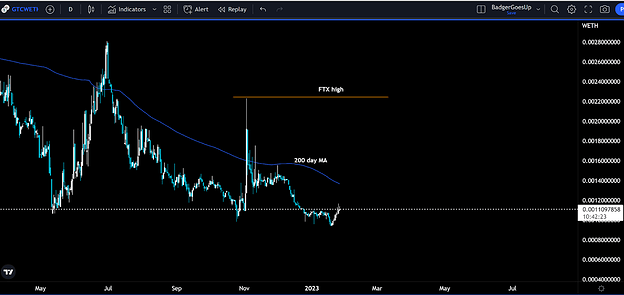

The first key point of interest is the 200 day Moving Average, currently at 0.001361. This is a likely place for GTC/ETH to find resistance as that has been the case for the past year. Under the current price is the lower consolidation that formed at the end of 2023. This would be an area that likely would act as support for the price. Because the price could retest this level of support, I am recommending to initially sell 30% of BadgerDAO’s GTC holding into ETH and provide a small amount of ETH liquidity down to this range. This is a small hedge and will allow for fees to be collected during any short period of downside volatility. This lower consolidation level is at 0.00106.

The final range would be from the 200 day moving average up to the local high created just before the FTX collapse at 0.0022. These two ranges could result in a 30%+ gain in the amount of ETH the GTC is currently worth and could be larger depending on the path the price takes and the amount of volume and fees earned.

Note when the above background information was originally written, GTC/ETH was at a much lower ratio. During that time the prices have changed and now the suggested ranges have been collapsed to one along with a one time sale of 14.5% of the GTC position into ETH at market price.

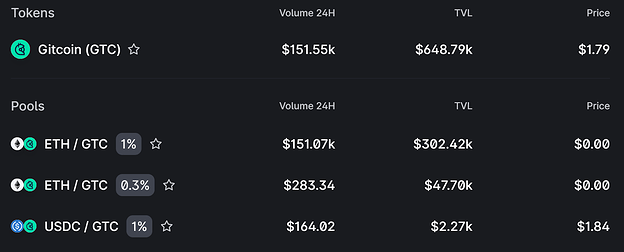

Current On Chain Liquidity:

Because BadgerDAO’s Treasury currently holds $200k GTC. It has been recommended to deposit into the 0.3% fee pool rather than the 1% fee pool. It is expected that this concentrated liquidity will be enough to redirect nearly all volume back to the 0.3% pool and be more competitive with CEXs or the UniV2 pool. Initially we’d expect to capture over 80% of the fees until whoever is in the 1% pool migrates to the 0.3% pool.

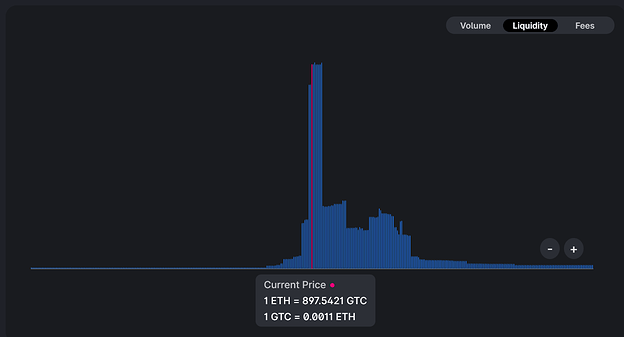

Current Liquidity distribution in ETH/GTC 1% pool.

Currently, the liquidity in the 1% swap pool is very concentrated around the price. The next largest chunk goes up to 0.004 GTC/ETH, this is nearly twice the height suggested above at only 0.022.

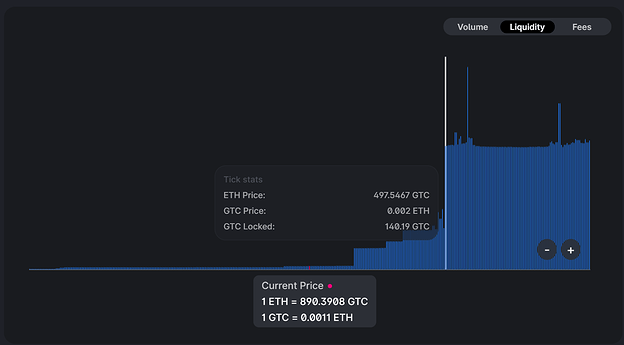

Current Liquidity distribution in ETH/GTC 0.3% pool.

As one can see there is very little liquidity in the GTC/ETH 0.3% pool and majority of the liquidity is being provided higher than the 0.0022 ratio that has been suggested above.

Recommendations

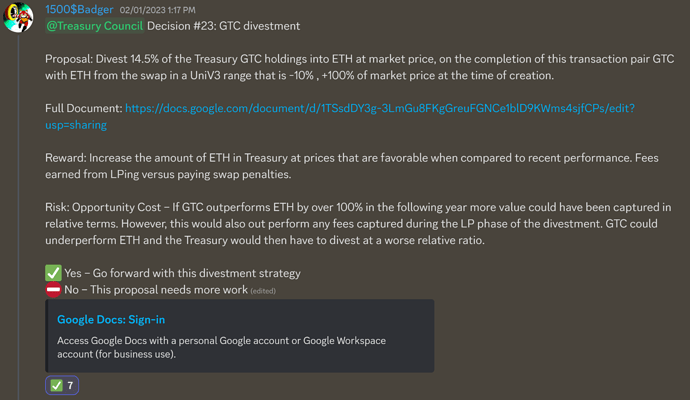

- Sell 14.5% of current GTC holdings

- The remaining GTC will be paid with ETH from the sale in a -10% +100%

Metrics of Success

How long will the investment thesis take to play out?

The expectation is around one year and if not complete in one year the parameters should be reassessed and changes should be made to the position at that time if the original thesis has changed.

Will the treasury recoup funds or does the investment represent an outlay?

The Treasury is expected to receive more ETH value from the position than the current valuation. This will come from a price rise and swap fees collected.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

2 - The position will be deposited in UniV3 and therefore susceptible to any smart contract risk associated with those contracts. However, UNI has a strong history with many audits.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

4 - There is little liquidity for selling GTC in the market. This position is intended to assist in increasing the liquidity depth.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

4 - This does not change the market risk of these assets however, if the price were to go down relative to ETH this would impact the expected return of this strategy, and possibly result in less ETH or USD notional value of the position.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

0 - There is no credit risk associated with this position.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

3 - There are execution requirements by the multisig to initialize the positions and to withdraw at the right moment in time.

Parameters For Program End

- The program should be assessed if GTC falls below 0.001

- 100% of the UniV3 positions are in ETH and not earning any fees