Valuing An Investment - FRAXBP TCL

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger on FRAXBP TCL Migration

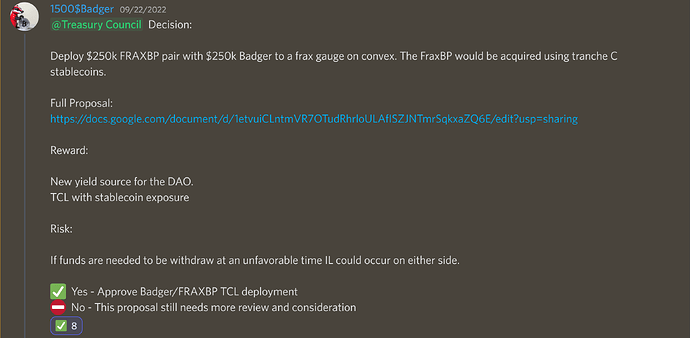

TLDR; Deposit $250k Badger along with $250k FRAXBP in a Badger/FRAXBP gauge on frax to earn FXS, CRV, and CVX. This program is expected to have short term boosted emissions due to a commitment from the redacted cartel who will vote with their veFXS temporarily for FRAXBP gauges in addition to some CRV/CVX boost on top of it from Convex.

Background

BadgerDAO has been successful in expanding its treasury controlled liquidity across several defi protocols. Some focused on deep liquidity for the token and others on providing sources of yields for the treasury and the BADGER token holders as well as increasing the liquidity depth for the token. The current forms of treasury controlled liquidity pair BADGER against WBTC in order to create a strong correlation between the two assets and allow users to maintain exposure to WBTC in yield farming.

The success of Badger in the Convex ecosystem along with the success of FRAX in Convex has created a unique opportunity for treasury controlled liquidity. Rather than pair BADGER with WBTC it can be paired with FRAXBP (FRAX/USDC). This pool would allow users more flexibility depending on their view of market conditions. This would also create a unique farming strategy for the treasuries stablecoins. In the event that BADGERs USD price falls the treasury stablecoins would be used to effectively buy back the token at a cheaper price.

Recommendations

- Deposit $250k Badger and $250k FRAXBP into a frax gauge on convex

- Acquire the FRAXBP with tranche C treasury stablecoins

Metrics of Success

How long will the investment thesis take to play out?

Indefinitely, this pool will drive yields to the DAO and help support the token’s liquidity.

Will the treasury recoup funds or does the investment represent an outlay?

The main goal is for the DAO to recoup the value of this investment through harvesting emissions and fees earned by the pool. If needed the funds can be withdrawn.

This investment may have a second order impact on the following:

- Support BADGER on chain liquidity

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

4 - This deposit utilizes FRAX, Curve and Convex as well as having exposure to USDC. There are a large number of protocols involved but all well established with large TVL.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

5 - The only risk is IL, it is possible the funds must be withdrawn in the future at an unfavorable ratio than desired in that current moment.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

5 -Drastic increases or decreases in the badger token price can create IL

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

2 - It is unlikely that yields will dry up from FRAX in the near term. This position is expected to receive yields for more than a year. Although the short term yields are expected to be elevated compared to the longer term.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

2 - While it is possible for this TCL deposit to be front-runned, it is unlikely that it will, considering the lack of liquidity for these assets on chain.

Parameters For Program End

- A new source is found to earn higher yields with this TCL.