tldr;

This proposal is to add 15 BTC and the requisite amount of BADGER to the LP, as well as have between 1500 - 3000 BADGER per week allocated for bribes on Hidden Hands to incentivize BAL rewards.

Badger/wBTC 80/20 Pool Investment

The gauge for the Badger/wBTC 80/20 pool has passed Snapshot governance on Balancer and will be available for voting and bribing via Hidden Hands next round (current round ends April 27. 2022).

This proposal is to add 15 BTC and the requisite amount of BADGER to the LP, as well as have between 1500 - 3000 BADGER per week allocated for bribes on Hidden Hands to incentivize BAL rewards.

Background

The BADGER/wBTC 80/20 pool was launched to create an opportunity for the DAO to increase depth of liquidity for BADGER with a less heavy wBTC position. In addition, it allows the DAO to take advantage of the young bribe and voting market of Balancer. By being one of the early adopters of the bribe market in Hidden Hands, we can utilize bribes effectively to grow liquidity and generate BAL and AURA rewards.

Hidden Hands has the power to incentivize 547,321.60 veBAL and currently has no bribe weight associated with any pools. Looking at current allocations of vote weight we can get an estimate of what votes bring in what APR:

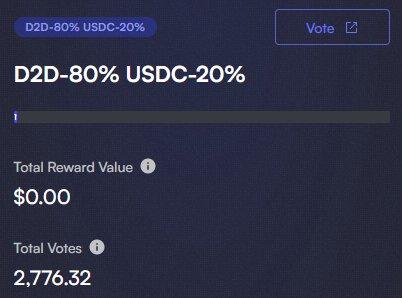

Looking at this example, 2776.32 (0.5% of votes) yields 117.93% base APR on $2m deposited.

To determine the amount of BADGER we would need to use the below formula

15 * $39,755.52 / .2 * .8 / $8.63 = 276,399.9073 BADGER

The proposed investment at this time is:

15 BTC ($39,755.52 * 15 = $596,332.80)

276,399.9073 BADGER = ($8.63 * 276399.9073 = $2,385,331.20)

Total Investment = $2,385,331.20 + $596,332.80 = $2,981,664

Depositing this amount brings us to a total pool size of $3,099,472 including the current deposits.

Bribing allocation of 1500 BADGER would be expected to drive a similar, if not larger, vote weight to the D2D/USDC pool, giving us around 79% unboosted APR at the same vote weight.

Metrics of Success

How long will the investment thesis take to play out?

The treasury will yield BAL assets immediately. These will be able to be invested in AURA when it launches, and this treasury position should be reevaluated after we see the effects of bribes on veBAL votes.

Note that the momentary success of the program can be measured by the ratio of bribes paid out to emissions earned on TCL. The program should be considered very healthy so long as the DAO is receiving at least 150% of bribes paid out in emissions for TCL. If at any point the DAO is earning less than 120% of bribes paid in emissions to TCL the program should be re-evaluated, with the potential to either expand TCL, increase pool capture and bring the program back to health, or to end the program and withdraw this TCL.

Will the treasury recoup funds or does the investment represent an outlay?

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

1 - Balancer is one of the oldest and well developed AMMs in DeFi. There have been no exploits and depositing into an LP position is considered low risk.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

2 - wBTC is extremely liquid, but adding 276k BADGER to the market is a large increase in liquidity for the token. As reference, Badger has 321k Badger in UniV3 TCL for 0.00025-0.00050 price range, so the treasury would sell 321k Badger through Univ3 and X Badger through Balancer at this range.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

4 - Badger has gone between $38 and $7 showing a high amount of volatility in the market, but we are not purchasing Badger, just having exposure to IL. There is a small risk that we’re putting uncirculating supply into the market, but in the event of a reduction of Badger price we’re also acquiring Badger from the market giving more control at any point to the protocol.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

0 - These are both base assets with no redeeming value

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

5 -The treasury multisig will need to sign to enter/exit these positions which at the moment could take up to 1 week. Rapid withdrawal from the position during some sort of black swan event would likely be possible, but no clear processes are in place to do so.

Council vote: