Valuing An Investment - veBAL vs CVX (the right mix)

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger and Tritium on the veBAL token.

TLDR; Convert some of BadgerDAO’s CVX to BAL to lock for veBAL. This will allow Badger to vote for BTC and Badger vaults on Balancer influencing yield redirection and increasing the APYs of these pools.

Background

One of the core values at BadgerDAO is to find sources of yield for BTC inside of DeFi. Curve is a genuine yield source that has had standing power in DeFi, and Convex helps DAO’s control where this yield goes. Holding CVX in the BadgerDAO treasury allows Badger to direct CRV/CVX yield to its various treasury assets and eventually its users. Specifically, BadgerDAO can lock CVX into bveCVX to direct yield to the wbtc/badger curve v2 pool (or other BTC pools). Badger’s biggest challenge with CVX so far has been that all pools need to 2 tokens and 50/50 and both single asset BTC investments and BTC/tokenX investments tend to either attract too few or too many investors to work out for BadgerDAO. As a result our Convex stash is being used to vote for yields on WBTC/BADGER.

Balancer is another established AMM with novel technology that is launching their own ve token. veBAL will be able to vote on which pools get BAL emissions, and eventually a Convex like protocol called Aura should emerge offering additional emissions on top. Balancer is interesting because it allows multiple token pools at any ratio. For example, Badger could create an ibBTC/WBTC/BADGER, 60/20/20 pool and vote on yields for that.

One of our main learnings from Convex, is that having DAO controlled influence is a lot about an early entry. This proposal is about swapping some of our convex/curve resources for BADGER. This includes:

1: The DAO currently owns 129k CVX. We propose taking 25k(about 19% of current supply or $630k) bveCVX and selling it for BAL and max lock for veBAL, which will then be used to vote for BADGER/WBTC 80/20 LP on balancer instead of BADGER/WBTC 50/50 on curve. veBAL is a Balancer Pool Token with 80% BAL/20 %ETH locked for 1 year.

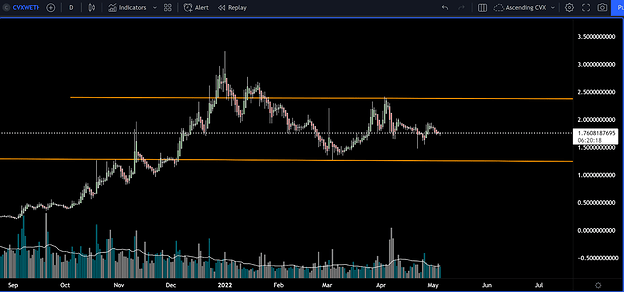

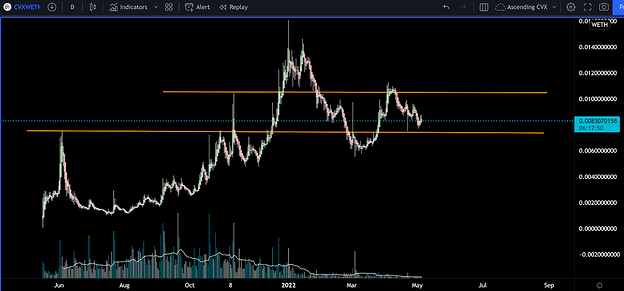

CVX Pricing - CVX/BAL and CVX/ETH pair analysis

This chart shows the relative price of CVX priced in BAL. You can see that over CVX’s short history its price was rising relative to BAL but now is losing value over the mid term. While the volatility between these two assets may be as high as 100%, the current mid term trend suggests BAL will hold a similar value to CVX or gain in value.

The CVX/ETH pair looks similar to CVX/BAL except the moves are of a different magnitude. Just as with BAL, CVX/ETH has been rising in price over the long term but is currently in a downward correction.

Overall there does not appear to be a large technical price risk that swapping CVX for BAL would produce missed opportunities over holding CVX. The yield available from this BAL move also greatly outweighs the yield currently being derived from the CVX position.

Yield:

CVX: Estimated at 30-50% bribe farming on 100% pool capture.

veBAL: Estimated at 400-800% voting for BTC/BADGER at 100% pool capture. Note that this number depends on either calculations from veBAL documentation(400%) or extrapolated from current data shown on the website (around 800%). Based on our experiences with CVX, we expect veBAL to direct well over its worth in annualized BAL until such a time as there is a bribe market in place to allow retail investors to efficiently arbitrage this premium.

About 800% estimation: veBAl performance calcs - Google Sheets (based on FEI/ETH votes vs yields 50% to max returns on boost).

About 400% estimation:

veBAL vs CVX Companion - Google Sheets (based on Balancer tokenomics documentation)

Competition

CVX is nearly in the cashcow stage. Bribe/yield markets are very efficient yield bribe/emissions ratio of between 1/1 and 1/1.3. There are many DAOs focused on arbitraging this bribe/emissions market, and the tooling is in place to make it easy to do so.

BAL on the other hand is an early day ve system based on top of a trusted brand/token. Bribe markets are not efficient yet, but 1 veBAL yields over 8 bal in the course of a year based on current voting/emissions. Because the tooling/tech is not in place yet, there are few players in this market and it’s easy to carve out a spot. As the tooling advances, knowledge about the veBAL ecosystem and control over influence will help us also carve out a spot in these ecosystems.

Recommendations

- BAL and ETH are currently priced at a historically perceived fair value relative to CVX and should be acquired by the DAO to increase yield to treasury wBTC/Badger holdings.

Metrics of Success

This investment should return at least 30% return on the investment in the first year. It is expected that this return should outpace any fall in the value of veBAL.

How long will the investment thesis take to play out?

The veBAL will be locked for 1 year. By the end of this year there will likely be metalayers that we will want to move into. This investment should be reassessed at the end of the lock.

Will the treasury recoup funds or does the investment represent an outlay?

Based on current estimations, the treasury should be able to quickly recover funds based on farming WBTC/BADGER. Even a 50% pool capture would allow for 400% yield(on the amount of our veBAL purchase). This BAL could be sold to recover the CVX over time, or the veBAL could be swapped back for CVX at the end of the year.

This investment may have a second order impact on the following:

- Enables the treasury to farm BAL

- Enables the treasury to farm AURA

- Increases BADGER liquidity

As yield will be directed toward wBTC/Badger with the CVX it creates more yield on the pool which may bring in more investors.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

2- Balancer is an established protocol, but their ve system is new.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

10- veBAL will be locked for a year and can not be transferred and sold. At best it should be kept in a separate accounting contract that can also hold Balancer farming positions to take advantage of boost.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

5 - BAL is historically volatile especially when compared to holding BTC.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

1 - The veBal system is expected to continue to provide yield.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

4 - The position will require locking into veBAL and rewards managed.

Council vote: