TL;DR:

- Add 15 BTC and corresponding Badger (about 309k currently) to the Badger/WBTC 80/20 pool on Balancer (about 2.2 $M of treasury funds total) to earn BAL.

Background:

Badger has deployed its first 15 BTC + corresponding Badger position and is bribing 3k Badger/week on Hidden hand.

Badger/WBTC Balancer pool is also being farmed by a large veBAL holder who votes for the pool, and a bunch of smaller veBAL holders who don’t vote but provide the liquidity.

At the moment our treasury position on Balancer is worth 2.3 $M (15.76 BTC + 324,226 Badger) and is earning 92% APR in BAL.

The majority of TVL in the pool has a high veBAL Boost ratio, while our treasury has none.

This means that even though the treasury provides 14% of TVL in the pool, it ends up getting only 8% of the rewards that go to the pool. And about 80% of TVL in the pool has high Boost ratio and farms 88% of the rewards.

Proposal:

The Proposal is to double our TCL on Balancer by deploying another 15 BTC and corresponding Badger (about 309k).

I view it as a rather conservative addition with the main goal of farming more BAL.

The projection is that by doubling our TCL:

- The treasury would start getting about 1.75x more rewards,

- TCL would represent about 25% of liquidity in the pool instead of 14%, which would allow farming 14% of the rewards instead of 8%.

- The high Boost depositors in the pool would start receiving about 6%-7% less

- Pool depositors with no Boost would receive about 12%-13% less

There is no change to the strategy of bribing 3k Badger / week on the Hidden Hand.

Metrics of Success:

- How long will the investment thesis take to play out?

The treasury will yield BAL assets immediately.

The plan is to use the BAL later on to acquire AURA that Badger plans to utilize as the influence asset in the ecosystem.

- Will the treasury recoup funds or does an investment represent an outlay?

The treasury will be able to recoup the funds if needed (minus the IL which is smaller on 80/20 pools and should be well covered by the current rate of rewards).

In the meantime, the funds will slightly deepen Badger’s on-chain liquidity.

-

What are the risks associated with each investment?

-

Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

1 - Balancer is one of the oldest and well developed AMMs in DeFi. There have been no exploits and depositing into an LP position is considered low risk.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

2 - Adding ~2.3 $M to Balancer liquidity wouldn’t affect Badger liquidity much.

It would increase Badger/WBTC Balancer liquidity by about 13%.

According to 1inch, a 100 WBTC Badger purchase uses Balancer for 34% of volume. And 1inch doesn’t route through the Curve V2 pool.

According to some quick estimates (using Balancer Tools), if Badger were to 2x from here, about 71k Badger would enter circulation from the added TCL position (308k Badger).

And about 144k Badger would enter circulation from a 2x move in total from the Badger’s Balancer TCL if we include the previously deployed position.

For reference, a 0.00025 → 0.00050 move would mean about 328k Badger entering circulation from the Uni V3 TCL.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

2 - The Market risk isn’t particularly applicable here since this is a TCL position. If Badger goes down, TCL buys Badger off the market, if it goes up, more Badger enters circulation while there’s more BTC that’s supporting its downside.

So TCL doing its thing is generally more important than the IL exposure.

The IL exposure though on an 80/20 pool is much lighter than on a 50/50 pool - about 2x lighter on average (Balancer Tools).

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

0 - These are both base treasury assets

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

3 - The treasury multisig will need to sign to enter/exit these positions which at the moment could take up to 1 week. Rapid withdrawal from the position during some sort of black swan event would likely be possible, but no clear processes are in place to do so.

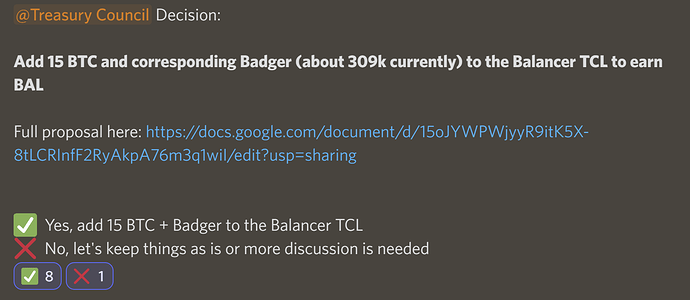

Council Vote:

Execution can be tracked in this GitHub issue.