Valuing An Investment - BADGER Covered Call Options [Revised]

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger on BADGER Covered Call Options.

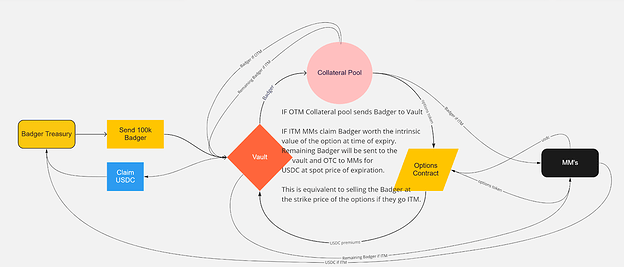

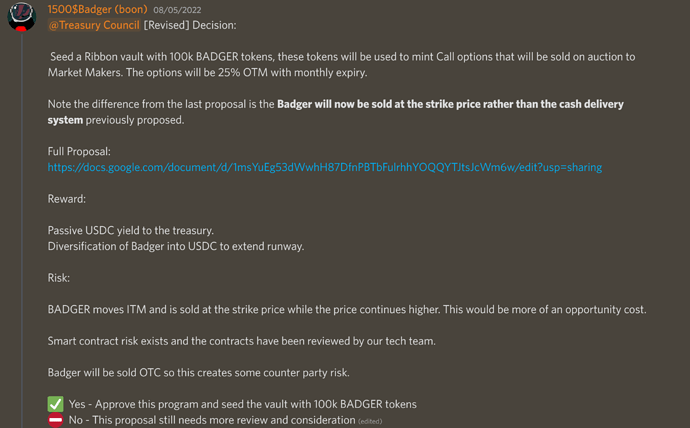

TLDR; BadgerDAO will deposit BADGER tokens into a Ribbon finance smart contract (vault). These tokens will have covered call options minted against them and a premium will be paid in USDC to the contract. BadgerDAO can then claim this premium at any time. If the call options expire in the money the counter parties can withdraw Badger tokens equivalent to the USD intrinsic value of the options at time of expiry. Any remaining tokens will be sold to market markers at spot price at time of expiry. This will effectively sell the Badger at the strike price. Initially the program will start with 100k Badger tokens with 25% OTM strikes at a monthly expiry.

Background

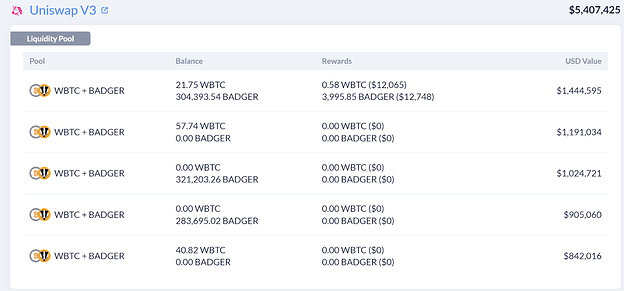

BadgerDAO has three major programs for providing treasury controlled liquidity. The first program (UniV3) is intended to support the tokens liquidity first and foremost. While there are fees being earned, the main purpose of the UniV3 liquidity program is its efficiency of liquidity depth. Some UniV3 researchers have suggested that UniV3 ranges can be up to 2x more efficient than UniV2.

The two other major liquidity programs are, besides providing more depth on other platforms, also focused on generating yield for the BadgerDAO treasury.

Badger Treasury Control Liquidity

Uniswap V3

Curve

This Convex position is currently earning ~20% APR

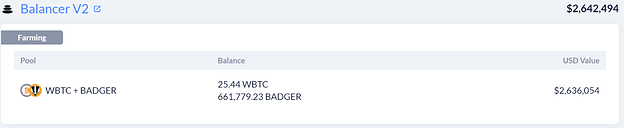

Balancer

This Balancer position is currently yielding ~22% APR.

Update: as of 08/05/22 The Balancer position is now deposited in AURA earning ~29% APR.

Non-stablecoin Yield

One major shortcoming of these programs is that all of the yield is generated in non-stablecoin tokens. This has created a cash flow problem in the treasury. In order to maintain a stablecoin runway the treasury must sell these yields into cash. This is a problem because many of these tokens being farmed are useful for compounding future yields.

Covered Call Program

The basic program is shown in the diagram below. BadgerDAO would deposit 100k Badger into a smart contract that will allow the minting of call options. An initial auction will allow a group of market makers to bid for the options. After the auction the decided premiums will be deposited as USDC into the contract. This USDC is claimable by BadgerDAO. The call options will be 25% out of the money with one month expiries. At the end of the period if the options are in the money the market makers will be able to withdraw the intrinsic dollar value of the options in the form of BADGER tokens from the contract.

The estimates sent from Market makers suggest stablecoin yields of about 5-9% APR. One would expect these yields to be more stable than the Balancer or Curve yields, because they would not be diluted by others and they do not carry the market risk of non-stablecoin yields. However, Badger options expiring ITM will have a negative impact on this yield.

Competition

There are other on chain sources for selling call options. However, Ribbon has demonstrated that there is an appetite for these call options confirmed by Market Makers. Using another options provider could run the risk of not having any counter parties interested in buying the options.

Recommendations

-

Deposit 100k Badger into Ribbon’s contract for Market Makers to mint covered call options.

-

Reassess the program each time any amount of the 100k Badgers are sold “In the Money”. To determine if the program should be topped up or allowed to diminish naturally.

-

100% of the premiums will go to maintaining stablecoin runway

Metrics of Success

How long will the investment thesis take to play out?

3 month trial run

Will the treasury recoup funds or does the investment represent an outlay?

There are two scenarios and the possibility of a mixture of the two:

- The call options expire OTM and BadgerDAO collects premiums as a monthly USDC yield

- The call options expire ITM and BadgerDAO will sell Badger tokens at the strike price

This investment may have a second order impact on the following:

- Increases in off chain liquidity

Market Makers who will purchase these call options will hedge with perps. This will help to create a more stable price on centralized exchanges.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

3 - Ribbon has a history of safe smart contracts and the contracts will be reviewed by Badger’s tech team.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

8 - If the BADGER is needed by the DAO it will not be able to remove it from the contracts until after expiring. This could result in a month of the liquidity being “trapped”.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

5 - Badger is a high volatility asset. It’s possible it rallies a large amount in a month and the Badger must be sold at the strike price rather than at a higher price.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

4 - Premiums are paid up front and at the end of the month Badger is withdrawable from the contract. The Badger will be sold OTC if ITM so there is a risk the counter party does not send funds.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

1 - Ribbon finance manages the execution after Badger deposits into the vault. The vault deposit will require a single multisig transaction.

Parameters For Program End

- Interest waines in making a market for Badger so premiums dry up

- A higher yield source is found paying USDC

- After 3 months this program needs a vote from the treasury council to continue. This will mean no more than 300k Badger can be sold during the duration of this program.