Valuing An Investment - AURA/Balancer Compounding Influence Strategy

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger on AURA/Balancer Compounding Influence Strategy

TLDR; The aura ecosystem is expanding quickly and the treasury decisions to purchase balancer and aura along with moving Badger/WBTC and WTBC/DIGG/graviAURA TCL to AURA has resulted in large inflows of both BAL and AURA into the Badger treasury. The following proposal is a strategy to build a large influence position in the BAL/AURA ecosystem while adding incentives to Badger and DIGG liquidity, adding utility to Badger and maintaining a runway for the DAO.

Background

The graviAURA vault on Badger allows users to deposit AURA which is then vote locked to earn bribes. Badger charges a 10% fee on this influence to vote for the WBTC/Badger pool on AURA/BAL. This provides utility for Badger holders looking for boosted yields on Badger vaults and also a way for the DAO to earn more BAL and AURA tokens by depositing treasury controlled liquidity. The effect is increasing the depth of liquidity of the Badger token and bringing more WBTC to Balancer. This also assures bribes are voted on efficiently because graviAURAs main task is bribe voting. A WBTC/DIGG/graviAURA pool has also had great success on balancer bringing in $5mil in TVL of which 40% is WBTC.

APYs

The APY on the DIGG vault are very high and over voted for at the time of writing. We do not expect this to last, but to discourage over voting graviAURA in the pool now votes for bribes on core pools. This helps create direct pay to core pool LPs and to BalancerDAO treasury. We expect this yield will not remain elevated for long and will eventually return to the intended size which is proportional to the graviAURA in the pool.

The Badger/WBTC APY can scale based on the size of bribe capture of graviAURA. This is BadgerDAOs fee for providing an automated efficient bribe market.

Strategy Phase 1 -

Compound current yields. Because current APYs are projected to be significantly higher than future APYs it would be best for the treasury to compound this first set of yields. They will be claimed July 29, 2022 and the following will be done:

- Deposit 25000 AURA into graviAURA

- Deposit 12.5 DIGG, 6.3 WBTC, 25000 graviAURA into AURA vault (graviAURA value fixed, no more than 6.5 WTBC to be used)

- Deposit 12000 BAL into auraBAL

- Use any remaining AURA and BAL to buy upto 1.5WBTC depending on prices

Strategy Phase 2 -

Governance will need to be passed to allow the treasury to hold up to [20-30]% of its non-native asset value in auraBAL and graviAURA. This is similar to the rule in place for Convex holdings. If and only if a BIP is passed to allow this, should the following strategy continue to be executed by the treasury once auraBAL + graviAURA reaches a combined 10% of treasury holdings as allowed by the treasury policy.

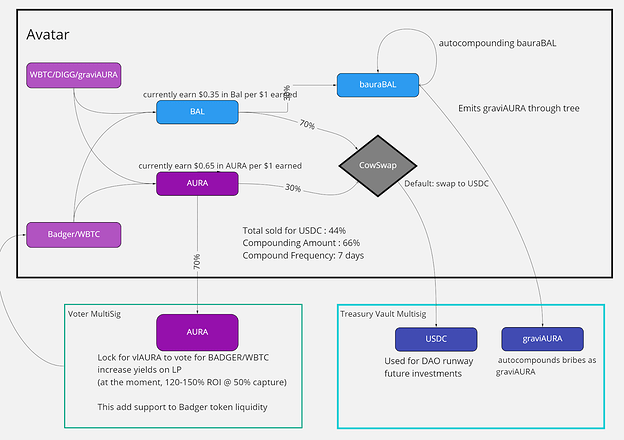

Auto Compounding Strategy-

After a one time execution of phase 1. The Treasury will begin managing rewards in the following way.

Every 7 days this will claim rewards, sell 30% of the AURA to USDC, sell 70% of the BAL to USDC, deposit 30% of the BAL into bauraBAL and send 70% of the AURA to the voter multisig where it will become vlAURA. The USDC can be used for DAO runway, buying WBTC, BADGER. The use will be addressed in other treasury decisions.

Strategy Phase 3-

Avatar

In conjecture with this decision, the tech team will construct an avatar (set of smart contracts) that will execute Strategy 2 in an automatic way. This will create an autonomous treasury strategy running on its own. The goal is to complete a prototype by Q4 and once it has been deemed safe begin scaling the size of the strategy by sending it treasury funds.

Metrics of Success

How long will the investment thesis take to play out?

Immediately the treasury will begin earning higher yields. The second phase (manual execution) could persist into Q1 2023 and expect to produce stable coin yields for the treasury.

Will the treasury recoup funds or does the investment represent an outlay?

The main goal is for the DAO to recoup the value of this investment through harvesting emissions and fees earned by the pool.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

3 - This requires taking on both AURA and Balancer protocol risk. Balancer is one of the oldest DeFi protocols with a strong history, AURA is newer but has been audited and is currently receiving another audit.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

8 - This strategy will build a large position in auraBAL and vlAURA which will be illiquid and hard to exit if liquidity is needed. This also includes DIGG liquidity risk.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

5 - BAL and AURA are both high volatility assets

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

6 - It is unlikely that AURA and Balancer will not distribute emissions to this pool when it votes for its own emissions. It is possible that Balancer governance could remove the gauges in the future through a vote.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

3 - The manual execution phase will require many multisig transactions. Building the avatars will be a long term project requiring auditing and testing.

Parameters For Program End

- Balancer or AURA ecosystem no long deliver influence utility to BadgerDAO

- Yields fall below other sources could require divestment