Valuing An Investment - Stablecoin Holdings

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger on BADGER Stablecoin Holdings.

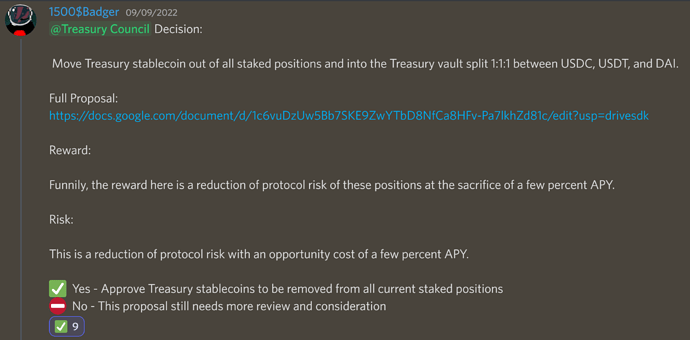

TLDR; BadgerDAO has been farming with allocations of the stablecoin holdings in the BadgerDAO Treasury. When this farming began APYs were high as many protocols offered boosted emissions. Now that the APYs are single digit or less they do not represent enough return for the risk being taken. This proposal is to move all of the stablecoin holdings currently in staked positions to naked in the Treasury Vault. These will be split 1-1-1 between USDC, USDT, and DAI.

Background

When protocols like AAVE, Compound and Curve first launched there were high value token emissions to stablecoin pools. BadgerDAO was able to take advantage of this early stage of these protocols and farm tokens with it’s stablecoin holdings. However, as time has progressed these protocols have reduced their token emissions and moved to APYs based off borrowing rates or fee generation. This has resulted in APYs that were 20%+ to now be less than 1% in some cases.

Recommendations

-

Move 100% of BadgerDAO Treasury’s stablecoin holdings out of any yield farm and into the naked assets in a wallet split between USDT, USDC and DAI. The usual operational funds for the upcoming quarter will still be stored in USDC.

-

The stablecoins can be used for future opportunities with proper risk adjusted rewards.

Metrics of Success

How long will the investment thesis take to play out?

Indefinitely.

Will the treasury recoup funds or does the investment represent an outlay?

Moving these stablecoins to naked in a wallet will represent the least risky position in the treasury holdings. This will reduce the protocol exposure of the funds.

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

1 - This move effectively reduces the protocol risk to Ethereum and the backing of the stablecoins

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

1 - This does not change the liquidity risk of these positions.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

1 - This does not change the market risk of these assets compared to being deposited in yield farms.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

1 - This does not change the market risk of these assets compared to being deposited in yield farms.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

1 - This reduces the execution risk by moving these assets into the Treasury vault.

Parameters For Program End

- When single sided staking yields are found that produce reasonable risk/reward. This will most likely mean farms with more than single digit APY or if the stablecoin holdings in the Treasury become more substantial.

- If investments are found that represent reasonable risk/reward for the Treasury such as yield influence assets.

- Other unique farming strategies are discovered with proper risk/reward.