Valuing An Investment - DIGG TCL Migration

The performance of each treasury asset and the treasury as a whole must have clear accountability to allow future governance by BADGER token holders. The following is research by $1500Badger on DIGG TCL Migration

TLDR; Recently, a Balancer gauge has been approved for a liquidity pool that is 40% DIGG, 40% wBTC and %20 graviAURA. This pool has the unique advantage that the graviAURA in the pool will vote for itself to receive emissions. BadgerDAO has DIGG/WBTC TCL currently deposited in Sushiswap which is earning 0.3% swap fees. Moving the TCL to Balancer/AURA will create an larger opportunity for the TCL to scale with a growing AURA ecosystem as well as help provide opportunity for BadgerDAO users to obtain DIGG for boosted emissions.

Background

BadgerDAO has three major programs for providing treasury controlled liquidity. The first program (UniV3) is intended to support the tokens liquidity first and foremost. While there are fees being earned, the main purpose of the UniV3 liquidity program is its efficiency of liquidity depth. Some UniV3 researchers have suggested that UniV3 ranges can be up to 4000x more efficient than UniV2.

The two other major liquidity programs are, besides providing more depth on other platforms, also focused on generating yield for the BadgerDAO treasury.

Badger Treasury Control Liquidity

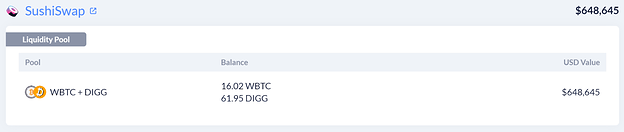

Sushiswap

BadgerDAO currently holds ~$650k in WBTC/DIGG liquidity as TCL on Sushiswap. This is earning 0.3% swap fees with no other incentives. The DAO no longer has ample DIGG holdings able to emit to users to encourage them to provide liquidity in this pool.

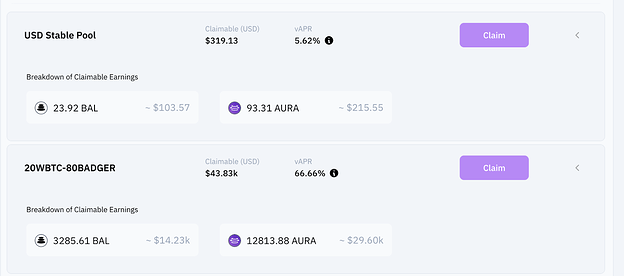

Aura Holdings

BadgerDAO currently has 45,647.2 AURA already deposited in graviAURA and an additional 12813.88 and 93.31 AURA claimable from farming returns. The claimable AURA can be deposited into graviAURA and the sum of these three sources used to pair with DIGG/WBTC in the 40/40/20 pool on Balancer. The graviAURA in the pool will then vote for the pool and direct emission to the DAO. This is not only expected to provide a direct return to the DAO through emissions but will also naturally scale with other uses outside of the DAO providing liquidity since graviAURA in the pool will vote for itself.

Recommendations

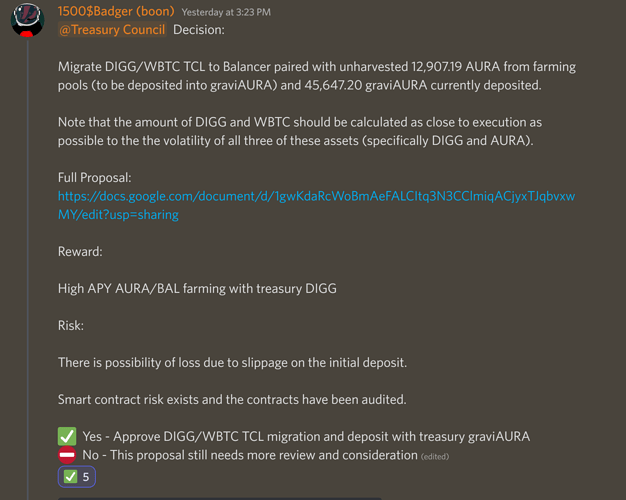

- Harvest 12907.19 AURA from farming pool into graviAURA and pair this with the 45,647.20 AURA already in the pool with the USD equivalent DIGG and BTC TCL from Sushiswap to deposit into the Balancer pool to match the required 40/40/20 required to balance the pool. Note that the amount of DIGG and WBTC should be calculated as close to execution as possible due to the volatility of all three of these assets (specifically DIGG and AURA).

Metrics of Success

How long will the investment thesis take to play out?

Indefinitely, this pool will drive yields to the DAO and help support and grow the DIGG marketcap.

Will the treasury recoup funds or does the investment represent an outlay?

The main goal is for the DAO to recoup the value of this investment through harvesting emissions and fees earned by the pool. Growth in DIGGs marketcap will also positively impact the DAO’s total treasury holding. If needed this investment can be moved out of Balancer and the WBTC or graviAURA can be sold at marketprice. Majority of farmed rewards will be sold at a monthly cadence into stablecoin to support DAO runway.

This investment may have a second order impact on the following:

- Increases DIGG’s marketcap

- Increase in graviAURA owned by the DAO

- Increase in number of Badger users holding DIGG for boost

What are the risks associated with each investment?

- Protocol risk (0 - 10)

Likelihood of a smart contract or a system of smart contracts (protocol) is exploited or funds are lost

3 - This requires taking on both AURA and Balancer protocol risk. Balancer is one of the oldest DeFi protocols with a strong history, AURA is newer but has been audited and is currently receiving another audit.

- Liquidity risk (0 - 10)

Liquidity risk refers to how easily an asset can be bought or sold in the market.

8 - As this is a TCL position it is unfavorable to sell the underlying assets. However, it is possible and would result in a higher percentage loss due to slippage.

- Market risk (0 - 10)

Market risk is the risk that arises from movements in stock prices, interest rates, exchange rates, and commodity prices. Metrics to consider : VaR, skew, sharpe.

5 - DIGG and AURA are currently low liquidity assets that have high volatility.

- Credit risk (0 - 10)

The risk of loss from the failure of a counterparty to make a promised payment, this should cover airdrops expected

2 - It is unlikely that AURA and Balancer will not distribute emissions to this pool when it votes for its own emissions. It is possible that Balancer governance could remove the gauge in the future through a vote.

- Execution risk (0-10)

How long will it take to execute, how many signers on a Multisig or queue of things that must be signed first.

2 - While it is possible for this TCL deposit to be front-runned, it is unlikely that it will, considering the lack of liquidity for these assets on chain.

Parameters For Program End

- A new source is found for providing TCL for DIGG/WBTC that provides higher yields or better incentives for DAO users.

Transaction of migration:

https://etherscan.io/tx/0x58411b0a1139a754f6bbf1480160fb0a59da0f2a6da3cd8376887fd56ce75b3a